Finding the right cycling apparel manufacturer in Europe affects your brand's reputation directly. Asia handles mass production well. But European cycling clothing makers give you something different: top-tier quality, advanced technical innovation, and craftsmanship that serious cyclists spot right away.

Here's the challenge. Not all cycling apparel of European manufacturers deliver the same results. Partner with the wrong one? You risk six months of delays, poor product quality, and a damaged brand image before launch.

I've spent years working with Europe's cycling apparel manufacturers. From family-run Italian workshops to Swiss innovation labs, I've seen what works. This guide shows you six European cycling apparel manufacturers that deliver premium products for ambitious brands. You'll learn which factory handles small-batch custom orders best. You'll see who owns the technical patents that count. Most important? You'll match your brand's needs with the right manufacturer's capabilities.

Launching a boutique cycling label? Scaling an existing line? These insights help you avoid costly mistakes. Find a manufacturing partner who lifts your vision instead of holding it back.

Santini Cycling (Italy) - UCI Official Partner with 60-Year Heritage

Santini earns credibility where it counts most: on the backs of world champions. The Bergamo-based maker of cycling apparel holds the UCI's official technical partnership. This relationship goes back to 1988. That's when Maurizio Fondriest claimed the World Championship wearing their cycling apparel jersey. The cycling clothing partnership just got renewed through 2031. That's 43 straight years of working together.

The UCI Partnership Portfolio

This isn't just about rainbow jerseys anymore. Santini supplies competition wear across 14 UCI disciplines. These include road, track, para-cycling road and track, and mountain bike (excluding downhill and enduro). Also marathon MTB, cyclo-cross, indoor cycling, gravel, esports, snow bike, and junior track. They make leaders' jerseys for UCI Women's WorldTour rankings. Plus they handle multiple UCI World Cup categories: para-cycling road, MTB eliminator, trials, artistic cycling, and cycle-ball.

The scope matters for makers looking at partnerships. Santini manages worldwide marketing rights for 14 UCI events. This includes the UCI Cycling World Championships for 2027 and 2031.

Race-Proven Collaborations

Trek-Segafredo has trusted Santini since 2017. That same practical approach extends to IRONMAN Group. Santini became their official technical cycling apparel supplier in 2019.

Their event partnerships read like cycling's greatest hits. Tour de France and Tour de France Femmes get leaders' jerseys from 2022. La Vuelta from 2017 onward. Paris-Roubaix, Liège-Bastogne-Liège, Tour de Suisse, Deutschland Tour, and Santos Tour Down Under all partner with them. For Paris-Nice and Critérium du Dauphiné, they've developed special collections since 2022.

What This Means For Your Brand

Sixty years of making experience shows in their ability to handle complex multi-event contracts. They can manage several at once. The UCI relationship proves production consistency. They deliver the same quality for 20 rainbow jerseys or 2,000 team kits.

Their product line goes beyond competition wear. You'll find UCI-branded technical cycling clothing, leisure wear, and accessories with rainbow stripes. Regular product launches show active R&D investment. They're not just resting on their legacy.

Assos (Switzerland) - Premium Innovation Leader in Technical Racewear

Assos doesn't follow trends in cycling apparel. They create them. Since 1976, this Swiss maker of cycling apparel has built a reputation on firsts. These firsts changed how serious cyclists dress. First Lycra® cycling shorts. First carbon bicycle frame. First sublimated jersey. These weren't marketing gimmicks. They were technical solutions. Solutions that became industry standards.

The numbers tell part of the story:

This ratio signals premium positioning and efficient focus. They operate from Stabio, Ticino. Swiss precision meets Italian design sensibility there.

Patent-Driven Performance Technology

In 2001, Assos introduced the Elastic Interface cycling short insert. Before this, chamois padding was static. Riders shifted all the time to relieve pressure. The Elastic Interface concept changed that. It uses multi-density foam zones ranging from 40 to 120 kg/m³. Different thickness areas help riders stay comfortable. You get 2mm at the edges and 14mm at sit-bone contact points. This reduced pressure without adding bulk.

This elastic coverage layer cut friction and shear force during the pedal stroke. The technology became the benchmark. Other premium cycling apparel makers chase it. Their S5 generation shorts (2008) and S7 platform refined this further. Each version used pro-peloton feedback. It solved real discomfort during multi-hour rides.

The "Choose Your Comfort" Framework

Assos recognized in 2003 what many brands still ignore. Fit preferences vary widely among cyclists. Their system lets riders select comfort levels. You choose based on riding style, body type, and personal preference. Not S/M/L guesswork. Actual fit designs for different compression needs and movement patterns.

Project Starburst (2004) showed their commitment to aerodynamic gains. They called it "the fastest cycling bodysuit on earth." Bold claim. But Assos backs this with fabric research and layering science. Their three-layer system follows proven thermal management principles. The moisture-wicking base layer uses special fiber combinations. The middle layer insulates using brushed knit or lightweight thermal materials. The outer shell blocks wind and water while still breathing.

Etxeondo (Spain) - Handcrafted Excellence from Basque Country

The Basque mountains shape cycling culture in their own way. Etxeondo operates from Irura, a small town. Design teams work meters from production floors. Each garment travels just 100 kilometers from Irura's design studio to the Castejón factory in Navarra. Both locations stay in Spain. Both stay under Etxeondo's direct control.

This close distance matters. The design team can walk into the sportswear factory within an hour. Adjustments happen fast. Pattern issues get fixed between morning coffee and lunch. Fabric tests don't wait for email chains across time zones. The feedback loop stays tight.

Small-Scale Production Philosophy

Etxeondo employs between 11 and 50 people. Compare that to Asian contract factories running 500-worker lines. This isn't a mistake. It's a choice. Small teams handle complex work better than big production lines. Custom colorways, logo placements, and fit changes happen without disrupting schedules. There are no mass production schedules to disrupt.

The company doesn't publish production volumes. No pieces-per-month targets appear on their site. No capacity claims. This shows different priorities. Quality control happens through direct oversight. No statistical sampling needed. The person who cut the pattern can check the finished bib shorts. Defect rates drop on their own.

Technical Fabric Approach

Etxeondo built its reputation on thermosystem thermal fabrics . This material system handles cold-weather riding in the Pyrenees and Alps. The brand also uses Gore-Tex membranes in outerwear pieces. Gore licenses its technology carefully. Brands must pass Gore's internal standards for waterproofness and breathability. Etxeondo cleared those requirements.

Summer jerseys carry UV protection marketing. Most reference UPF 50+ sun protection . But specific lab test reports aren't made public. Standard numbers like EN 13758-1 or detailed UPF papers stay internal. The same pattern shows up across their fabric specs. Water column measurements, breathability values (MVTR), and abrasion resistance cycles (Martindale test data) stay private.

Custom Kit Realities

Looking for 5,000-unit team orders with three-week turnaround? Etxeondo likely isn't your factory. Their in-house model favors small to mid-size team programs . Think boutique cycling clubs. Think specialized racing squads. Think brands that put craft over volume.

They don't publish minimum order quantities. No price ladders appear for custom designs. Lead times stay hidden. This frustrates procurement managers used to instant quotes. But it also filters requests. Serious inquiries get personal attention. Mass-market buyers move on.

The Basque approach trades size for control. You won't find Etxeondo supplying multiple WorldTour teams at once. Their factory size doesn't allow it. You get something else instead. Direct access to the people making your shorts. The flexibility to adjust mid-production. Garments that carry visible handwork details mass production can't copy.

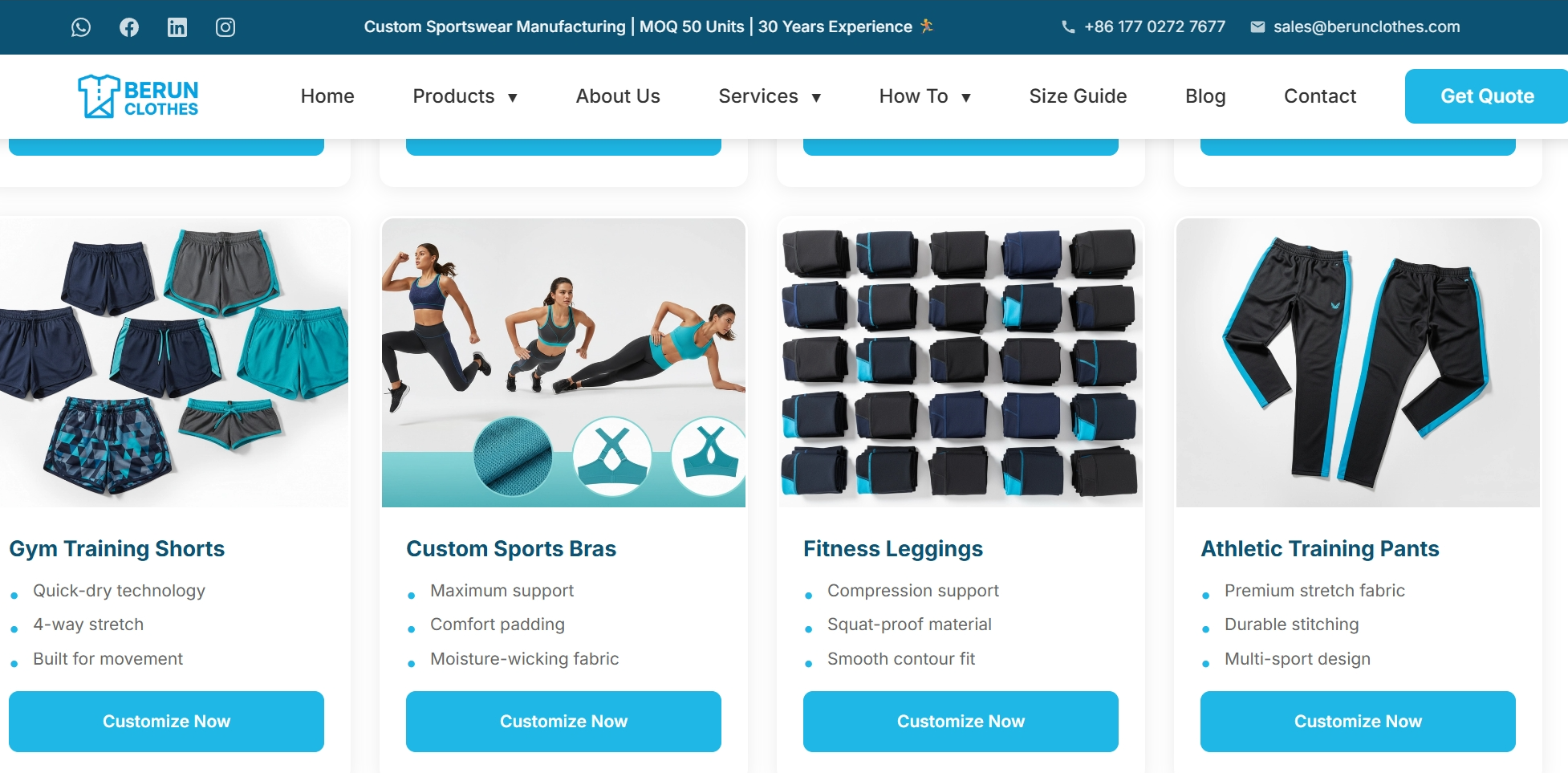

Giordana (Italy) - Pro Custom Team Gear Specialist

WorldTour teams and weekend club riders walk through the same door at Giordana. The family-owned cycling apparel factory in Italy's Veneto region treats a five-jersey order with the same care they give Astana Pro Team. Since 1986, this approach built something rare. A maker that scales down just as well as it scales up.

The Zero-Minimum Custom Platform

Most European cycling apparel makers set barriers. Twenty-piece minimums. Setup fees that hit $500 before you see fabric. Giordana removed those gates. No minimum order quantity exists. You need three jerseys for your gravel crew? They'll run it. The first price break kicks in at five pieces per garment. Not five total. Five of each design.

Their online Kit Builder platform handles the tech side. You pick fabrics, cuts, and base colors. Then their designers take over. The Hood River team wanted their local map printed across jerseys. Giordana's team turned that idea into print-ready artwork. No charge for design time at the five-piece mark. No setup fees on the invoice.

Size samples ship before production starts. Try the fit. Check the cut. Send feedback. Then they make your order. Four weeks covers most items in their catalog. Rush orders cost more, but standard times work for clubs planning seasonal kits.

FR-C Pro™: Astana's Fabric, Your Logo

The FR-C Pro™ line carries the same specs Astana's riders wear during Grand Tours. Same Italian fabrics. Same printing process. Same fit standards. Giordana doesn't make a "custom version" with cheaper materials. They pull from the same fabric library.

Simon Yates needed a mid-season re-fit during his Mitchelton-Scott contract. Giordana's team used the same measurement process they use for amateur orders. The process doesn't change based on UCI points or Instagram followers. This consistency matters for your brand. Your customers wear the same quality as riders they watch on TV.

Green Manufacturing Without the Marketing Noise

The Veneto facility runs practices that exceed EU standards. Fabric scraps get recycled. Skylights cut electrical needs during production hours. Paper waste feeds back into recycling programs. They don't broadcast these practices in campaign slogans. The operations team just built them into workflows decades ago.

Individual shipping for size samples. Online payment that captures deposits without wire transfer waits. Unlimited color matching from their fabric library. These details separate real custom programs from wishful ones. The Bottom Bracket Bashers needed specific delivery dates. Giordana hit every timeline. Hood River's team reported 100% intent to reorder. Not because of discounts. Because the process worked as promised.

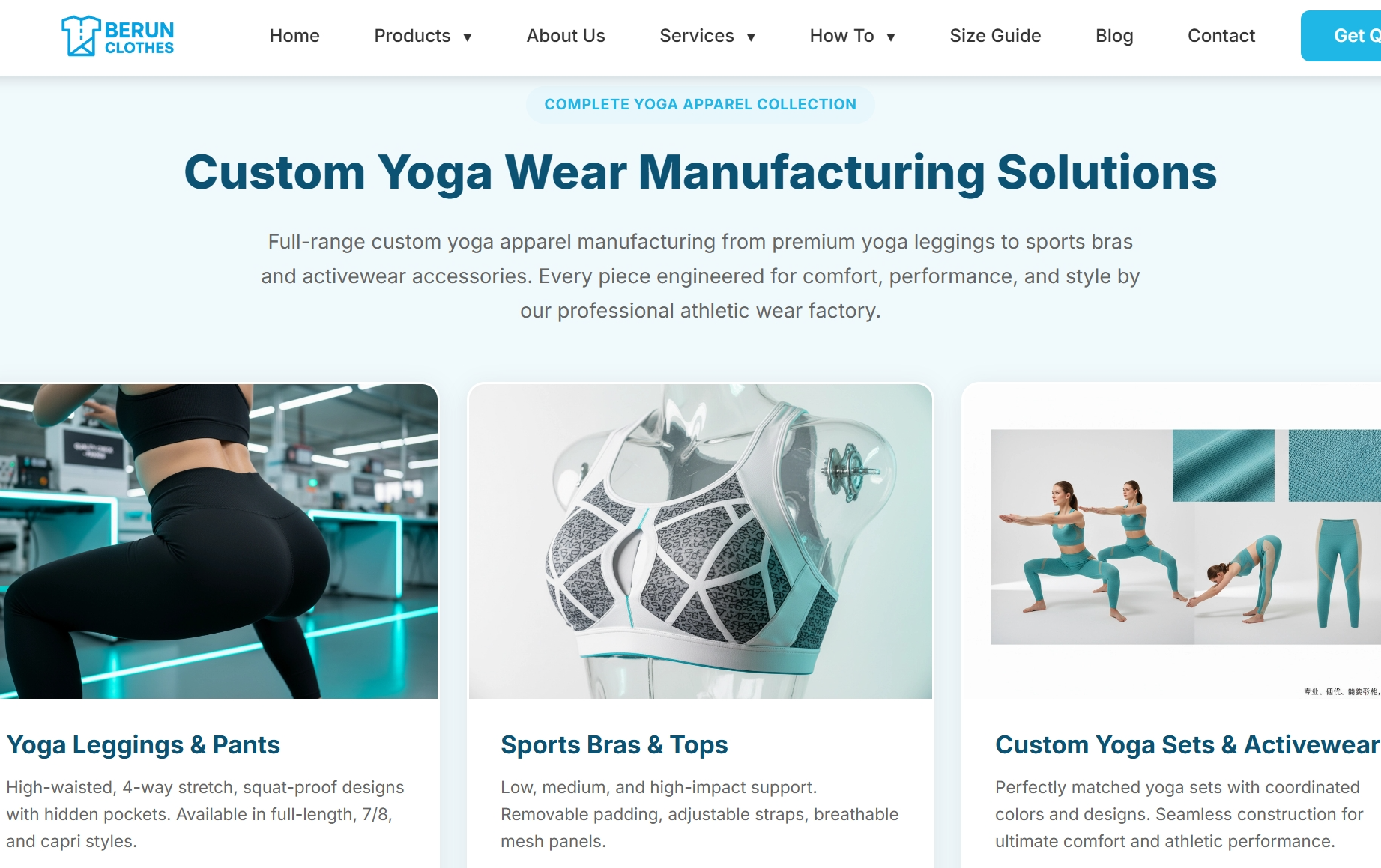

Cafe du Cycliste (France) - Technical Performance Meets French Aesthetic

The Côte d'Azur creates a unique cycling culture. Not the grinding, suffer-fest mentality of Belgian cobbles. Something different. Technical precision wrapped in effortless style. Cafe du Cycliste captures this from their Nice headquarters at 16 Quai des Docks.

Their sustainability credentials speak through numbers:

The median B Impact Score sits at 50.9 for ordinary businesses—Cafe du Cycliste nearly doubles that. They earned B Corp certification in July 2024. Every package they ship uses compostable or recyclable materials. No plastic mailers. No bubble wrap waste.

Production Philosophy With Measurable Results

About 80% of production stays in Europe. Their factories operate near Nice. Short chains from factory to customer mean tighter quality control. Plus, you get smaller carbon footprints. The team increased recycled yarn use across collections. Virgin materials keep dropping. They certify more factories in their chain each year.

Cafe du Cycliste joined 1% For the Planet . Revenue percentages go to green causes. Not leftover profits. Actual sales numbers. Their Recycliste platform launched in France first. Now it grows across markets. This resale system keeps garments in use longer. Repair patches come standard. Scraps turn into new products instead of waste.

Collections That Merge Function and French Design

The Race collection gives you premium support through technical fabrics. You get speed without losing comfort. Audax pieces target distance riders. Details matter on long rides. Good chamois placement. Hem grippers that stay put. Pockets you can reach.

Their Manon jacket uses race-fit softshell construction for bad weather. The Charlie line handles all-day adventures. Marinière stripes nod to French naval history. Full movement fit means no restriction on climbs or descents.

They operate in 16 countries: Austria, Canada, China, Colombia, Germany, Italy, Japan, Singapore, South Korea, Spain, Switzerland, Taiwan, UK, and US. This spread shows their style works across different cycling cultures.

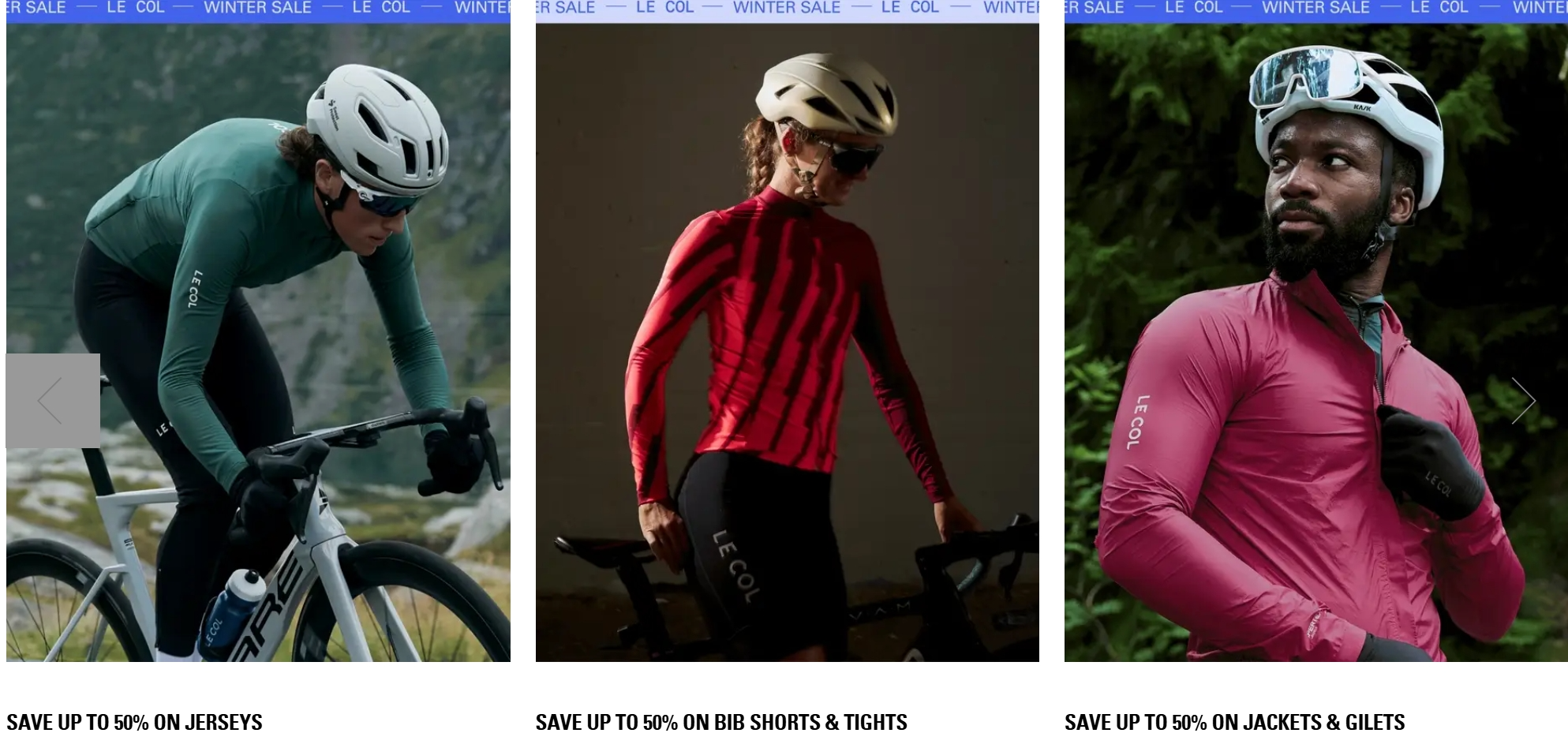

Le Col (UK) - Pro Peloton-Proven Kits for All Performance Levels

World Tour feedback shapes every panel, seam, and fabric choice at Le Col. The UK brand takes wind tunnel data and rider insights from pro racing. They build products for cyclists at every level. Your Sunday club ride gets the same aero advantages as Grand Tour stages.

The Pro Collection: Race-Day Tech Without Compromise

The Pro Jersey carries specs that matter during hard efforts. Aero-optimized cuts stop fabric flutter above 40 km/h. Fast-wicking fibers pull moisture away as intensity climbs. Quick-drying properties keep you comfortable through pace changes. UPF 50+ protection blocks sun damage during long training blocks. The temperature range sits between 18-25°C—perfect for spring classics and summer crits.

Wind tunnel sessions refined the fit. World Tour riders tested aggressive racing positions. The result? High compression fabrics of cycling apparel that support muscles during peak efforts. Fewer seams mean less pressure points. Articulated panels follow your body in the drops.

The tight fit sits next to skin like a second layer. Bonded laser-cut edges at sleeves and hems cut bulk. Silicone grippers hold position without elastic bands. The Vislon zip runs smooth under race effort. Front length drops shorter than traditional cycling jerseys—built for the drops, not casual riding. Zero wrinkling. Zero excess fabric catching wind.

Pro Versus Sport: Choosing Your Performance Tier

The Sport Collection serves different purposes. Training rides. Sportives. Commutes. Less tight fits work better for varied intensities. Breathable stretch polyester handles sweat without race-level compression. Three rear pockets plus one zippered secure pocket carry tools and nutrition. Silicon dot grippers at leg hems stay put without cutting circulation.

Sport II Bib Shorts use 9-panel construction with a 3-layer chamois. The gel insert cushions sit-bone pressure during multi-hour efforts. These aren't race shorts. They're built for the training volume that makes racing possible.

Pro Collaborations That Deliver Results

Sir Bradley Wiggins brought his palmares to Le Col in 2018. The partnership created different ranges—each tier matched to specific riding demands. World Tour riders keep feeding data into product development. Muscle support metrics during hard efforts. Moisture wicking rates at threshold power. Drag reduction measurements from bonded finishes.

The Pro Air Sleeveless base layer costs $66. Open mesh design boosts airflow. Moisture draws away from skin before it pools. Long cycling socks use honeycomb polyamide yarn with strategic cushioning zones.

Pro Jersey pricing sits at the premium end—you're paying for proven performance gains, not marketing claims. Sport Jersey drops to $149, balancing quality with access for serious amateurs.

How to Choose the Right European Cycling Apparel Manufacturer for Your Brand

Europe holds 44.6% of the global cycling apparel market in 2025. That percentage gives you real leverage. You're not chasing distant cycling apparel suppliers across time zones. You're working with makers who understand performance standards that shaped the sport itself. But size doesn't guarantee fit. The Netherlands has 23 million bikes for 17 million people. That cycling-first culture produces cycling apparel manufacturers who know what works. They also know what fails after 500 kilometers.

Your brand stage determines which factory makes sense. New labels need different things than established lines. Here's how to match capabilities with your actual needs.

Match MOQ to Your Current Reality

Startups burn cash on inventory mistakes. Order 5,000 units before you've proven market fit? You're gambling. Look for makers handling 100-500 piece minimums. Slovak operations like Isadore work at this scale. Your initial budget stays under €50,000. You test designs with real customers instead of warehouse space.

Mid-stage brands expanding lines need 500-2,000 unit capacity. Castelli's innovation platform works here. You've got sales data now. You know which cuts sell. Scale up proven designs. Test new concepts in smaller batches at the same time.

Mature operations running 5,000+ piece orders chase different benefits. ASSOS-level partnerships give you custom technical development. You get exclusive Lycra formulations. You get special fabric treatments. You're not buying catalog products anymore. You're building technology that competitors can't copy.

The European cycling clothing market hit USD 1.25 billion in 2023. It's growing at 8.2% each year through 2030. E-bike sales jumped from 3.3 million units in 2019 to a projected 5.8 million by 2025. This surge creates delivery pressure. Factories balance increased demand against quality standards. Your MOQ choice needs to account for their production calendar, not just your budget.

Verify Quality Through Certifications That Matter

OEKO-TEX Standard 100 certification proves fabric safety. No harmful chemicals touch skin during 8-hour rides. GOTS certification (Global Organic Textile Standard) backs sustainability claims with audited proof. Europe's 32.42% market share in 2024 came from eco-conscious buying. Customers pay premium prices for proven environmental practices.

ISO 9001 quality management separates serious operations from marketing stories. Check client case studies. Castelli supplies pro teams because their defect rates stay below 5%. Rapha built RCC community events (1,000+ each year) on consistent product quality. One batch of failed chamois pads kills that trust.

Request samples before commitments. Budget €200-500 for 5-10 prototype pieces. Test them across 500 kilometers of actual riding. Lycra durability shows up in the wash. Chamois comfort reveals itself on the fourth straight day. Stitching quality matters at 45 km/h stretched across the top tube.

Control First-Order Risk

Premium European pricing ranges from €30-80 per unit (mid-tier like Endura) to €50-150 (Rapha and ASSOS levels). These numbers assume standard designs. Custom tech development costs more upfront. But it protects your brand later.

Structure payment terms smart: 30% deposit locks production slots. Hold 70% until post-inspection approval. Build in delivery penalties—5% per week past the 8-12 week standard. Europe's professional cycling apparel manufacturers hit 95% on-time delivery rates. Your contract should match that benchmark.

Add IP protection clauses for custom designs. Include minimum yield guarantees at 95% or higher. Test with a 100-unit trial run before scaling. Check every detail: stitching tension, dye fastness against OEKO-TEX standards, pad placement accuracy.

Communication speed shows how well you'll work together. Premium European cycling wear makers respond to quotes within 12 hours. They support English plus local languages (Italian, German, French). Initial emails take three days? That pattern continues through production problems.

The global cycling apparel market grows from USD 2.28 billion in 2025 to USD 3.36 billion by 2032. That's 5.69% CAGR across all segments. Amateur riders drive this growth. They value quality but watch budgets closer than sponsored teams. Your manufacturer choice either captures this expansion or misses it.

FAQ: Your Top Questions About European Cycling Apparel Manufacturers Answered

Procurement managers ask the same questions. Every time. The answers separate smart partnerships from expensive mistakes.

What's the Real Minimum Order Quantity for European Manufacturers?

Custom team kits start at 10-50 complete sets (jersey plus shorts). Your local cycling club qualifies. Small ODM/OEM facilities require 100-300 pieces per design per colorway . This covers full sublimation printing on technical fabrics. Larger operations serving established brands set minimums at 300-500 pieces per design . High-compression race gear pushes that to 500+ pieces .

Accessories drive numbers higher. Zippers, silicone grip bands, and reflective strips often require 500-1,000 meters per color . Custom fabric specs hit 500-1,000 meters per color minimums. That's about 250-600 jerseys worth of material.

Smart factories offer flexibility. "Per design, not per size" policies let you order 100-300 total pieces while splitting across S-XXL sizes. Each size needs just 5-10 units . Total order minimums work better for multi-design launches. Order 200-500 total pieces across different styles and colors in one production run.

Below standard MOQs? Expect 15-40% price premiums for runs under 50-80 pieces. Sample production skips MOQs. Pay sample fees for 1-5 pieces per size during development.

How Long Does Production Take?

First orders from European makers span 8-14 weeks start to finish. Stock fabrics shorten this to 6-10 weeks . Custom dyeing extends it to 10-16 weeks .

Here's the timeline breakdown: Initial quotes take 3-7 days . You need to provide quantities, target pricing, fabric specs, functional requirements, size distribution, and logo placement details. Design confirmation runs 2-5 days with your artwork. Factory design services need 5-10 days for first drafts. Then 7-14 days total across 1-3 revision rounds.

Fabric sourcing splits two ways. Stock fabrics clear color approval in 1-3 days . Custom colors require 7-15 days for strike-offs. Plus 15-30 days for bulk dyeing. Sampling takes 5-10 days for pattern development and first samples. Sublimation print, embroidery, and silicone badge approvals add 3-7 days . Fit adjustments need another 5-10 days for revised samples. First-time partnerships spend 3-6 weeks from initial request to approved sample.

Pre-production setup (tech packs, pattern grading, scheduling) takes 3-7 days . Production runs vary by volume: 10-20 days for 100-300 pieces across sizes. 20-30 days for 300-1,000 pieces. 30-45 days for orders above 1,000 pieces. Quality inspection adds 3-7 days using AQL 1.0-2.5 standards. Packaging with poly bags, hang tags, and size labels needs 2-5 days . European shipping runs 3-7 days by express. 5-14 days by truck or rail.

What Price Should I Expect Per Piece?

These prices assume standard designs. Premium positioning justifies higher per-unit costs when your target customers value quality over price.

These numbers assume standard designs. Custom technical development costs more upfront. But it protects your brand differentiation. Payment terms split 30% deposit to secure production slots. The remaining 70% waits until post-inspection approval. Build delivery penalties into contracts— 5% per week past agreed timelines. Professional European cycling clothing manufacturers maintain 95% on-time delivery rates .

Conclusion

Europe's cycling apparel makers offer something rare in today's market: Cycling apparel's craftsmanship that won't be compromised . Santini brings six decades of mastery. Assos runs innovation labs that push boundaries. These six manufacturers give you more than production capacity. They're partners who know your brand's reputation depends on every seam, every fabric choice, every detail that separates premium from average.

The right European cycling apparel manufacturer extends your design vision. This isn't just a vendor checking boxes on a purchase order. Launching a boutique label? Scaling an established brand? Either way, European production delivers quality consistency, technical expertise, and brand credibility. Asian cycling apparel manufacturing can't match this, no matter how cheap.

Your next move? Don't treat this as a simple cycling apparel supplier search. Schedule calls with 2-3 manufacturers whose values match your brand DNA. Ask about their R&D process. Request fabric swatches. Discuss sustainability commitments. The cycling wear manufacturer who asks tough questions about your vision? That's the partner worth choosing.

Quality always finds its market. Make sure your manufacturing partner shares that belief.