Picking between China and Vietnam for gym clothing manufacturing goes beyond just finding cheap prices. You need to know which production hub fits your business goals, timeline, and quality needs.

I've looked at hundreds of sourcing choices. Here's what stands out: China vs Vietnam gym clothing manufacturers each rule different parts of the athletic wear market. They do this for clear reasons.

China brings huge production power and deep technical skills for performance fabric innovations. Vietnam has become the top choice for brands that want good prices with better quality standards.

The stakes? They're high. Pick the wrong manufacturing partner and you face delayed launches. Quality problems pile up. Profit margins vanish faster than your customers' New Year's gym resolutions.

This comparison breaks down real production costs. You'll see actual MOQ requirements, quality benchmarks, and hidden factors most buyers miss.

Launching your first activewear line? Scaling to seven figures? You'll get a clear framework for making this critical decision about your manufacturing partner.

China Vs Vietnam Gym Clothing Manufacturers: A Buyer's Comparison

Two countries dominate gym clothing manufacturing. Each controls different market segments.

China holds 35% of global apparel exports (down from 40% in 2015). Vietnam takes the growth China gives up—over $10 billion in apparel and textiles each year. Activewear is Vietnam's core specialty.

Here's what matters for your sourcing decision:

Manufacturing Scale & Capability

- China : Massive capacity with advanced tech (seamless bonding, laser cutting, functional fabrics)

- Vietnam : Medium-to-high capacity. Fewer mega-factories with high-tech processes.

Cost Structure Reality

- Vietnam : Lower labor costs. Better unit pricing for standard gym wear.

- China : Higher base costs. But efficient supply chains and shorter lead times balance this out.

Supply Chain Maturity

- China : Complete integration—local fabrics, trims, printing, logistics.

- Vietnam : Growing ecosystem. Still imports most materials. This extends lead times.

Brand Alignment Examples

Nike sources 49% from Vietnam now. Adidas cut China footwear production by 50%. The shift went to Vietnam. Puma increased Vietnam footwear by 160.7% in one quarter.

Premium technical gym wear brands still keep core production in China. Why? Unmatched R&D. Complex manufacturing capabilities no one else can match.

Your ideal manufacturing partner depends on your priorities. Need technical innovation and speed ? Choose China. Want cost efficiency at volume ? Vietnam is your answer.

China Gym Clothing Manufacturing Landscape

China's sportswear manufacturing engine generated $42.3 billion in revenue during 2023 , marking an 8.1% year-over-year climb. The broader market hit 492.6 billion yuan (about $68 billion). This isn't a dying industry. It's evolving.

Production Infrastructure That Scales

The numbers tell a clear story. In the first half of 2025, knitted apparel output jumped 1.38% year-over-year . This category now makes up 69.25% of China's total apparel production.

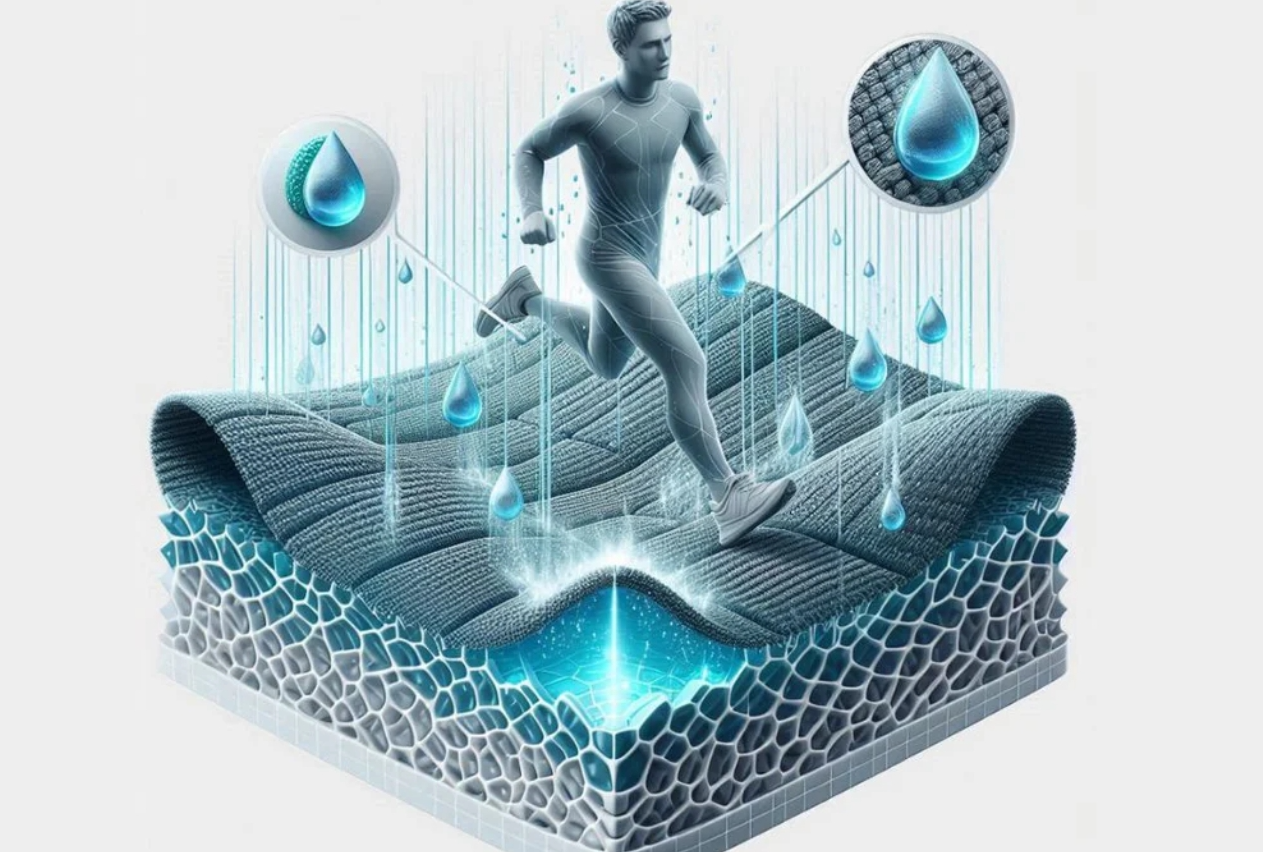

Why does this matter for gym wear? Most athletic clothing uses knitted fabrics. These are stretchy, breathable materials built for performance.

Woven apparel dropped 1.72% during the same period. Chinese manufacturers shifted focus to high-demand categories. They're following the money.

Material Cost Reality

Fabric costs eat up 60-70% of your total garment production budget in China. This shapes every pricing talk you'll have with suppliers.

Performance fabrics cost more than basic cotton tees. Think moisture-wicking polyester, nylon blends, spandex combinations.

Chinese manufacturers control extensive material supply chains right here. You're not waiting weeks for fabric shipments from overseas. Everything's within reach: cutting-edge technical textiles, traditional materials, specialty treatments.

Domestic Market Strength

Retail sales hit 534.13 billion yuan in the first half of 2025, up 2.5% year-over-year. Chinese factories aren't just export machines anymore.

They know what domestic consumers want. This gives you better product development insights if you're targeting similar demographics internationally.

Vietnam Gym Clothing Manufacturing Landscape

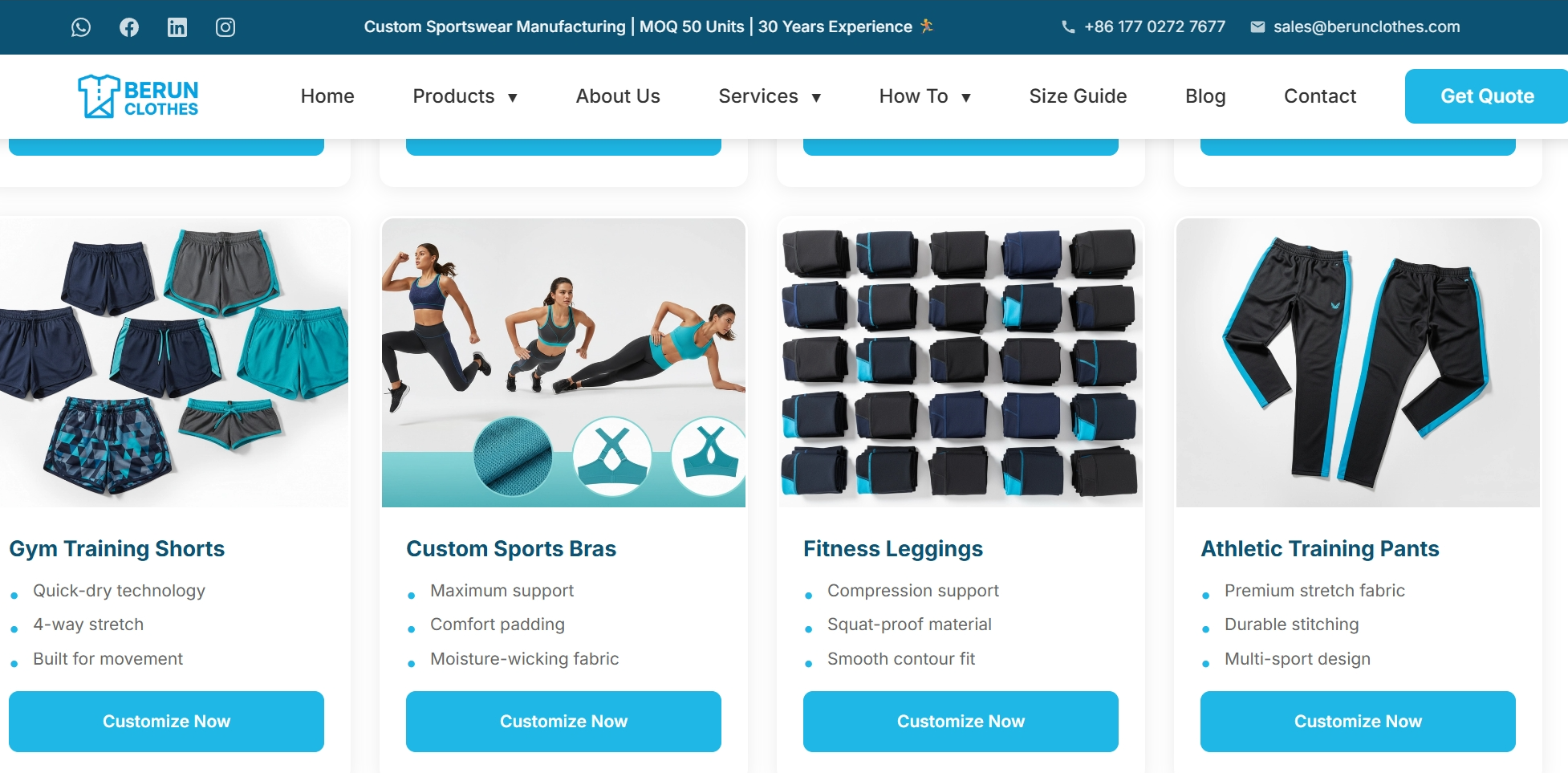

Vietnam's activewear sector grew from basic sewing to a $44 billion clothing export powerhouse in 2024. That's 3,800+ factories with 2.7 million workers making compression leggings, moisture-wicking tanks, and more.

The athleisure market alone? $1.61 billion in 2024 . It's expected to hit $3.01 billion by 2033 – a 7.2% annual climb . The domestic sportswear segment reached $792 million . It's heading toward $1.07 billion in the same period.

Where Your Gym Wear Gets Made

Southern Vietnam leads the pack . Ho Chi Minh City and nearby provinces control 38.7% of the sportswear market . More people live in cities here. Fitness matters more to consumers. Factory clusters are dense.

Binh Duong Province (near HCMC) has specialized makers like VinMake . They handle 100-piece MOQs for sportswear with fast prototyping. Perfect for startups.

Up north, Hanoi's industrial belt offers scale. Thang Garment Company runs modern facilities. 500 workers handle full OEM/ODM activewear. TNG Investment in Thai Nguyen Province operates 257 sewing lines . They produce 18 million pieces each year across outerwear and sportswear.

Technical Capabilities That Matter

Vietnam excels at functional knitwear . Seamless knitting tech. Compression garments made for athletic use. Standard MOQs are 300-600 pieces per style . Sample turnaround? 7-15 days . Bulk production? 60-90 days .

You'll find performance outerwear with waterproof and windproof fabrics as standard. Running jackets, warm-up layers, weather-resistant activewear – all available.

The shift started after 2018. US-China trade tensions pushed brands to try "China+1" strategies. Vietnam grabbed that opportunity. The country saw 10-12% annual pre-COVID growth in textiles and apparel.

Production Cost Breakdown: China vs Vietnam

Labor rates grab attention first. But they're just part of your real manufacturing spend. Smart buyers dig into the complete cost structure before signing contracts.

Labor: The 40-70% Price Gap

Vietnam factory workers earn $2.99-$3/hour based on 2020-2023 data. China? $6.50/hour in 2020. By 2024, Shanghai and tier-one cities push double that amount.

That's a 40-70% labor cost advantage for Vietnam on paper. Labor-heavy gym wear shows this best. Think basic tanks and simple leggings. Vietnamese facilities deliver 30-60% cheaper unit costs on these items.

But here's what changes the math: Chinese workers produce more per hour . Better training helps. Advanced machinery speeds things up. Refined workflows boost output. Vietnam's productivity grows at 3.6% each year – solid growth that still trails China's mature efficiency.

The result? China's unit labor cost stays competitive for high-volume runs. Automated production makes up for higher wages.

Raw Materials: The Hidden Cost Multiplier

Fabric sourcing exposes Vietnam's key weakness. Most materials ship from China . Your Vietnamese manufacturer orders polyester blends, spandex, and technical meshes from Chinese suppliers. Then waits for delivery.

China controls the complete ecosystem. Performance fabrics? Available down the street. Moisture-wicking treatments? Next door. Reflective trims? Around the corner. Zero import delays. Zero extra freight.

This affects design-for-manufacturing (DFM) speed . Chinese factories prototype faster. They grab samples right away. Vietnamese operations wait days or weeks for material shipments before cutting your first sample.

MOQ Flexibility vs. Production Scale

Vietnam wins the low-MOQ battle hands down. Order 100-600 pieces per style at facilities like VinMake. Startups testing designs love this. Brands with diverse SKU catalogs benefit too.

China? Factories quote 1,000-5,000 pieces minimum for competitive pricing. But that volume unlocks serious advantages. You get automated cutting tables. Dedicated production lines. Priority scheduling.

The trade-off: Vietnam suits small-to-medium batches . China takes over once you're ready to scale big.

Tariff Reality Check

US import duties shifted the game. Vietnam apparel faces 10% standard tariffs . China deals with additional 10% Section 301 tariffs active in 2025. That's a 20% total hit vs. Vietnam's 10%.

European buyers get even better terms. The EU-Vietnam FTA (EVFTA) eliminates 99% of tariff lines by 2027 . Vietnam also joins CPTPP and RCEP agreements. Duty-free access to major markets follows.

These savings stack fast on large orders. Import 10,000 leggings at $8 each? Vietnam saves you $8,000 in tariffs compared to China.

Total Landed Cost: Real Numbers

Let's calculate a 1,000-piece compression legging order :

Vietnam Route:

- Unit cost: $7.00 (lower labor)

- Freight: $0.80 (developing ports, longer transit)

- Tariff (10%): $0.78

- Total: $8.58/piece

China Route:

- Unit cost: $8.50 (higher labor, better efficiency)

- Freight: $0.50 (established logistics)

- Tariff (20%): $1.80

- Total: $10.80/piece

Vietnam delivers $2.22 savings per unit here. That's $2,220 total on this order. Scale to 100,000 pieces? $222,000 difference .

But flip the scenario. Look at technical seamless sports bras with bonding . China's special capabilities matter here. Faster sampling helps. Material availability wins. These factors often beat Vietnam's landed cost despite tariff penalties.

The Hidden Expense Categories

Lead times cost money – just in different ways. Vietnam's material imports extend timelines by 2-4 weeks . Miss a seasonal launch window? Lost sales dwarf any per-unit savings.

Quality control in Vietnam requires extra vigilance. Hire third-party inspectors at $250-400 per day . China's mature QC ecosystem offers more options. Competitive rates. Faster setup.

Tooling investments reveal another gap. Vietnam handles simple jigs and basic fixtures . China produces molds, dies, and advanced engineering tools . High-performance seamless gear needs these. China's infrastructure justifies the premium.

When Each Country Wins

Vietnam crushes it for:

- Standard gym wear that needs lots of labor (30-60% net savings)

- Small batch production (100-1,000 pieces)

- Brands that want to avoid tariffs

- Simple designs using common materials

China dominates for:

- High-volume automated runs (5,000+ pieces)

- Technical innovation (seamless, bonded, laser-cut)

- Rapid prototyping and sampling

- Projects needing special materials

Samsung and Foxconn figured this out years ago. They dual-source : China for parts and Vietnam for final work. You can use the same strategy. Source performance fabrics from China. Ship to Vietnam for cutting and sewing.

Your break-even calculation needs three factors: order frequency, design type, and target market tariffs . Run these numbers before picking either country as your main manufacturing base.

Minimum Order Quantity (MOQ) Comparison

MOQ requirements separate serious buyers from casual browsers in gym clothing. Here's the reality: Vietnamese manufacturers quote 300-1,000 pieces per style. Chinese factories demand 1,000-5,000+ pieces for competitive pricing.

This gap changes everything for new brands.

The Real Numbers Behind MOQ Flexibility

Vietnam built its reputation on easy entry . Startups ordering their first batch? Suppliers accept 100-300 pieces for basic gym wear. Facilities like VinMake focus on this range. New brands can't commit thousands of units upfront. Vietnamese suppliers get that.

China works another way. Minimum 1,000 pieces is standard. Even simple leggings or tanks start there. Technical items with seamless construction or bonded seams? You're looking at 3,000-5,000 pieces . Factories protect their margins. That's why they set these minimums.

What drives this difference? Setup costs . Chinese manufacturers put millions into automated cutting tables. They bought specialized machinery. Volume justifies the machine time. Vietnamese factories rely more on manual labor. Fixed costs run lower. So lower MOQs still make financial sense.

Break-Even Math You Need

Suppliers calculate MOQ with this formula: Fixed Costs ÷ (Selling Price - Variable Cost) = MOQ .

Example: A Chinese factory has $10,000 in setup costs. They sell compression shorts at $12 per unit. Variable costs are $6. Their break-even MOQ? 1,667 pieces ($10,000 ÷ $6 contribution margin).

Vietnamese competitors face $3,000 setup costs. Same margins apply. Their break-even drops to 500 pieces . Lower minimums still bring profit. That's the math behind their quotes.

Lead Time Analysis: From Sample to Bulk Production

Time kills deals faster than price ever will. Fast timelines win. Slow ones create stockouts in gym clothing manufacturing.

China delivers your first sample in 7-14 days. Vietnam needs 10-20 days for the same work. That skill gap shows up right away. But samples are just the starting line.

Bulk production tells a different story . Chinese factories finish 5,000-piece orders in 30-60 days . Vietnamese operations take 40-70 days . Peak season? Tack on 20% more time in Vietnam. The reason? Production lines stay fixed. Scheduling stays rigid.

The real bottleneck? Getting fabric . China sources from local mills in 10-20 days . Vietnam imports most materials from China. That means 30-60 days plus a 15-30 day customs delay . This fabric wait takes 20% of your total lead time .

Total timeline comparison hurts. China goes sample-to-delivery in 60-120 days . Vietnam stretches 80-140 days minimum.

Rush orders show the gap clearer. Chinese manufacturers cut timelines 30-50% by air-freighting fabrics. Vietnam manages 20-40% reduction. Customs won't budge. But speed costs. Expect 20-50% premiums in China. Vietnam charges 30-70% extra. Defect rates jump 10-20% versus China's 5-10% increase.

Quality inspection adds 5-10 days in China. 7-12 days in Vietnam. Your factory's delivery benchmark? Top suppliers hit 95%+ on-time rates . Anything below that signals serious problems.

Miss a Q4 launch by three weeks because fabric sat at Vietnamese customs? That's not a delay. It's lost revenue you'll never get back.

Quality Control & Manufacturing Capabilities

Manufacturing capabilities separate good factories from bad ones. Good factories ship on time. Bad ones destroy your brand reputation. China and Vietnam differ hugely in gym clothing production. The gap is massive, not subtle.

China leads in advanced garment technology . Seamless bonding systems work with thermal adhesive films at 10-30 g/m² weight. Machines control temperature at 140-180°C ranges . Pressure locks at 2-4 bar . Bonding time? 10-20 seconds . Miss any parameter and seams fail after 5 washes. They should last 20-30 cycles .

Chinese QC teams test bonded seam strength to 70-80% of base fabric breaking strength . No bubbling allowed. No peeling. Vietnamese facilities try seamless work but lack this precision equipment. The result? 15-25% higher defect rates on technical construction.

Technical Process Mastery

Four-needle six-thread construction reveals the experience gap. Chinese factories maintain 3-4mm stitch spacing with surgical precision. Thread tension stays consistent across 10,000-stitch runs. Skip stitch rate? Under 0.1% . Thread breakage? Below 0.5 per 1,000 stitches .

Vietnam's new manufacturers struggle here. Thread tension changes. Stitch spacing varies by ±0.5-1mm . This shows up during workouts. Your customer stretches their leggings 30-50% . Seams pop. Returns pile up.

Heat transfer printing for logos and designs needs exact control. Chinese printers set 150-170°C temperatures. They use 3-5 bar pressure for 8-15 seconds . Every transfer gets tested for wash fastness— Grade 4+ on ISO 105-C06 standards. Dry and wet rub fastness? Also Grade 4+ .

Graphics survive 20-50 wash cycles without cracking or peeling. Vietnamese suppliers quote these specs. But hitting them every time? That's where gaps appear.

Laser cutting precision shows the biggest capability divide. Chinese equipment cuts fabric with ±1-2mm tolerance . Advanced facilities achieve ±0.1mm on rigid materials. Edge browning on polyester stays under 1mm width . Zero melt droplets. Pattern repeat positioning accuracy? Under 1mm deviation .

Vietnamese laser cutting exists but runs at lower precision. Tolerance spreads to ±2-3mm . Edge quality varies more. High-volume brands notice this fast during garment assembly.

Performance Fabric Processing

Moisture-wicking finishes need controlled chemistry. Chinese mills test wicking speed using AATCC 195. Water droplets spread to 20-30mm diameter within 10-30 seconds . Moisture vapor transmission rates hit 5,000-10,000 g/m²/24h . These fabrics dry 20-50% faster than standard cotton.

Vietnam imports most performance fabrics from China. Local finishing capability lags 3-5 years behind Chinese textile chemistry. You get better moisture management by sourcing China-finished fabrics. This applies even if cut and sewn in Vietnam.

Antibacterial treatments use silver ion, quaternary ammonium, or zinc systems at 0.2-0.8% fabric weight . Chinese suppliers deliver 90-99% bacterial reduction against E. coli and Staph aureus (AATCC 100 testing). The treatment survives 20-50 home washes . It maintains 70-90% effectiveness .

Vietnamese facilities use these treatments. But testing infrastructure stays limited. Third-party lab verification adds 7-10 days to your timeline. It costs $200-400 per test batch.

UV protection matters for outdoor activewear. Chinese manufacturers produce UPF 40+ ratings (blocking 97.5%+ UV ). Premium lines hit UPF 50+ (blocking 98%+ UV ). UVA transmission stays under 5% . After 20 wash cycles , UPF degradation remains below 20% .

Vietnam can source UV-treated fabrics. But in-house treatment capability stays at tier-one suppliers.

Four-way stretch fabrics define modern gym wear. Chinese mills engineer 30-80% elongation in both warp and weft directions. Recovery rates exceed 90% after repeated stretching. Vietnamese fabric mills are growing. But they still import most technical stretch materials from Chinese, Korean, or Taiwanese suppliers.

Quality Assurance Infrastructure

China operates mature QC ecosystems . Third-party inspection companies like SGS, Bureau Veritas, and Intertek have offices in every manufacturing hub. Inspection costs run $250-350 per man-day . You can book next-day inspections during peak season.

Vietnam's QC infrastructure expanded fast. But density remains lower. Inspection scheduling takes 3-5 days longer . Costs run $280-400 per man-day . This is due to inspector travel requirements between provinces.

In-factory QC capabilities show the widest variance. Top Chinese manufacturers employ 1 QC inspector per 30-40 production workers . They use digital tracking systems. Real-time defect reporting. Automated fabric inspection machines catch flaws at 0.5mm resolution .

Vietnamese factories average 1 QC inspector per 50-80 workers . Manual inspection dominates. Digital systems exist at tier-one suppliers. Defect detection happens later in the production cycle. This raises rework costs.

Testing equipment availability creates another gap. Chinese facilities own tensile testers, color fastness machines, pilling testers, and wash testing equipment on-site. Turnaround for testing? 1-2 days in-house .

Vietnamese suppliers send samples to external labs for many tests. This adds 5-10 days and $50-150 per test type . Your product development cycle gets longer.

The capability difference isn't permanent. Vietnam invests in upgrading equipment and training. But right now, in 2025, China maintains a 3-5 year technical advantage in gym clothing manufacturing capabilities. Choose your supplier based on your product's complexity. Don't just look at the quoted price per unit.

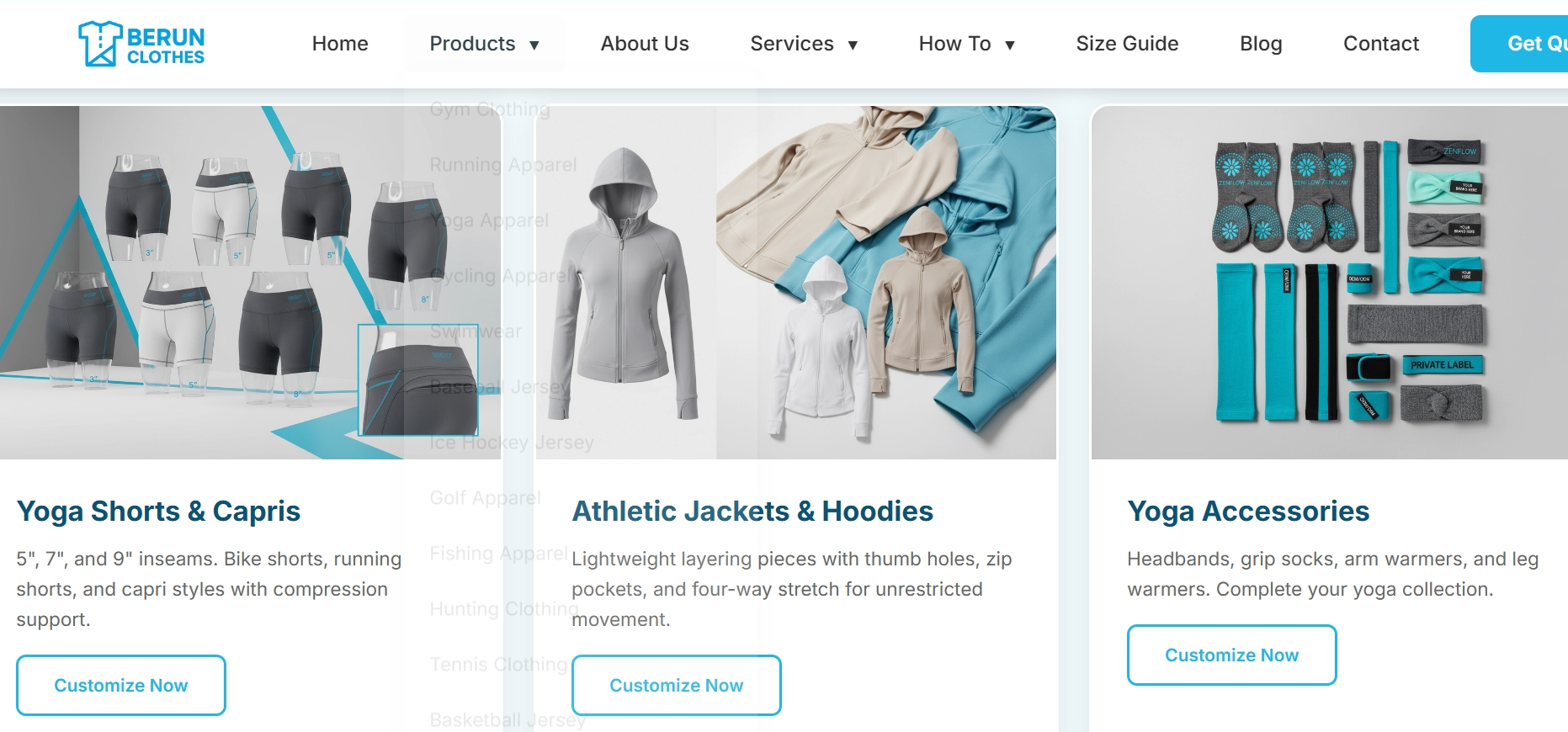

Customization & OEM/ODM Services

Chinese manufacturers offer complete design-to-production systems that Vietnam can't match yet. This gap decides if your custom gym wear stays a sketch or becomes real product in your hands.

Top Chinese OEM/ODM facilities have full design teams on-site . You get industrial designers, mechanical engineers, fabric experts, packaging designers, and sampling technicians all in one place. They turn your sketches into ready-to-make technical packs. No need to juggle three different vendors.

Sample speed shows the difference . Chinese factories make basic design samples in 7-14 days . Need new seamless styles or bonded tech? 3-4 weeks gets you from idea to physical sample. Vietnamese suppliers take 30-50% longer because they rely on outside design help.

Small changes show how fast they respond. Logo placement tweaks? Fabric color changes? Trim updates? Chinese ODM partners finish revisions and ship new samples in 1-2 weeks . Production switches over in 2-4 weeks . Vietnam handles these changes too, but working with offshore design centers adds 5-10 days at least.

Innovation ideas separate top partners from basic suppliers . Leading Chinese makers suggest fabric mixes you never knew existed. They show you build methods that cut costs 15-20% and boost performance at the same time. Vietnamese facilities do great work making what you specify. But new design options? China-based engineering teams bring 3-5 years more technical know-how .

The cost versus capability choice matters. Vietnam wins for basic custom work : standard colors, simple logo spots, basic size ranges. China leads in complex innovation : custom fabric creation, multi-material builds, technical performance tweaks. Pick based on how much new design work your brand needs.

Communication & Service Efficiency

Poor English costs more than missed emails. You face production delays. Quality gets misunderstood. Customer relationships fail. These issues eat profits faster than any price savings.

Chinese suppliers run mature B2B communication systems . Their sales and tech teams speak better English. They type 45-65 words per minute on technical specs. Vietnam's workforce is improving. But typing averages 30-45 wpm . Plus, you need more grammar checks.

Email speed shows the gap. Top Chinese makers reply to pre-sales questions in 4-8 hours . Tech questions? Solved in 1-2 emails . No endless back-and-forth. Vietnamese suppliers need 8-16 hours for first replies. Complex specs take 3-4 email rounds to get clear.

This gap grows during sampling. Chinese teams turn your needs into tech packs. ≥90% accuracy on first try . Mistakes that need sample fixes? Under 10% . Vietnam hits 75-80% accuracy . That means 20-25% more revisions .

Video calls show how deep tech knowledge runs . Chinese product managers answer 70-80% of tech questions right away on calls. Vietnamese teams handle 50-60% on the spot . The rest? They check with engineering later. Each delay costs you 2-3 days .

After-sales support works differently. Chinese factories run 24/7 WeChat/WhatsApp teams for urgent problems. Most issues? Fixed in 4-12 hours . Vietnam's support runs business hours most of the time. Urgent weekend problems wait until Monday.

Relationship styles differ too. Chinese suppliers suggest order timing changes before you ask. This helps you dodge peak season jams. They flag fabric price jumps 2-3 weeks early . Vietnamese partners help when you reach out. But fewer start planning talks on their own.

Customer scores prove the service gap. Chinese makers hit 75-85% CSAT with global clients. They solve ≥70% of tech issues on first contact. Vietnamese factories score 65-75% CSAT . First-contact fixes? 55-65% . The gap isn't skill. It's how mature their communication setup is.

Pick China for fast communication and precise tech support . Pick Vietnam if you have strong project management on your end. This helps bridge response delays. Go this route if you don't need instant tech help.

Sustainability & Ethical Manufacturing

Factory scandals cost brands more customers than bad products. Over 13,000 GOTS-certified facilities operate around the world in 2023. 5,000+ factories hold GRS certification for recycled materials. Most are in China, Vietnam, Bangladesh, and Turkey.

Certification Coverage: Where Each Country Stands

China leads in recycled polyester infrastructure . Major fiber producers have GRS coverage at mainstream levels. Chinese mills run the entire synthetic recycling chain. Polyester chips to yarn to fabric—all certified in one place.

Vietnam imports most certified materials. 30-60% of tier-one export factories hold GOTS or GRS certifications. They work with European and US brands that need traced supply chains. Smaller facilities can't afford certification. This splits the market into two tiers.

Recycled content goals drive sourcing choices . Major brands want 50-100% recycled polyester by 2025 . China supplies these materials in large volumes. Vietnam assembles products using imported certified fabrics.

Labor Standards: The Compliance Gap

Legal minimums don't match living wages . ILO standards set 48-hour workweeks . Overtime caps at 12 hours each week . Brand codes enforce 60-hour maximum including overtime.

Reality looks different. Electronic attendance systems track actual hours. China's established factories keep tighter controls . Digital tracking lines up with payroll records. Overtime gets documented and paid at 1.25-2x rates .

Vietnamese suppliers feel the squeeze during peak seasons. Smaller facilities rack up more overtime violations . Their audit failure rates run 15-25% higher than Chinese factories on working hours alone.

Wage transparency shows which factories comply . Living wage targets sit 120-200% above minimum wage . Top Chinese manufacturers of gym wear share their wage structures in public. Vietnamese factories meet legal minimums. But fewer hit living wage benchmarks.

Workplace safety is easier to check . Injury rates per million hours worked should drop each year. Emergency exits must fit worker capacity. China's industrial safety infrastructure is 3-5 years ahead. Fire systems, ventilation, PPE distribution—all standard at certified Chinese facilities.

Vietnam upgraded fast after Rana Plaza awareness grew. But factory density grew faster than safety inspector numbers. Third-party audits cost $800-1,500 no matter the location. Schedule them before you commit to any supplier.

Risk Factors: Tariffs, Geopolitics & Supply Chain Stability

Tariffs hit gym clothing buyers harder in 2025 than any year since the Great Depression. 82% of global supply chains report direct tariff damage across their operations. That's not a minority problem. That's almost everyone.

The impact spreads in different ways. 39% of manufacturers face supplier cost increases from new tariff structures. 30% watch customer demand drop as price increases kill sales. Consumer goods take the worst beating. 43% of activities get disrupted . Your compression leggings and moisture-wicking tanks? They sit right in this zone.

US-China trade tensions create the biggest headache . China restricted exports of critical minerals and rare earths in 2025. Yttrium prices exploded 4,000% in months. These materials are vital for specialized performance fabrics and treatments. Trump threatened tariff increases. China hit back with retaliatory tariffs. The back-and-forth chaos reshapes where products ship and how much they cost.

Vietnam offers zero tariff protection from this mess . Both countries face political uncertainty. This ranks as the top supply chain risk heading into late 2025. Chief economists see worse conditions ahead. 56% predict a weaker global economy driven by these exact tensions.

Supply chain disruptions happen every 3.7 years on average . They last over a month. But 80% of organizations dealt with at least one disruption in the past year alone . The old models broke. Disruptions became the new normal, not rare exceptions.

Only 8% of businesses control their supply chain risks in full . The other 92%? They're exposed. 63% report higher-than-expected losses from disruptions they didn't see coming. Real costs add up fast. Aerospace and defense sectors lose $184 million annually to disruptions. The Crowdstrike cyber-attack cost Fortune 500 companies over $5 billion in one incident.

Your gym clothing order might seem small compared to aerospace. But what happens if you miss your launch window? Container ships reroute around conflict zones. Those lost sales never come back.

Decision Framework: Which Country for Your Business Model

Picking your manufacturing country isn't random. You need a weighted decision model. This protects your profit margins and timeline.

Your business model drives everything . Starting a DTC activewear brand with 15 SKUs? Vietnam's 300-piece MOQs and lower setup costs fit that need. Growing an established fitness line with 50,000+ units each quarter ? China's automated production and material ecosystem give you better unit economics.

The framework has five strategic filters . These determine your best manufacturing hub:

Cost Structure Alignment

Labor takes up 20-40% of your total manufacturing spend in gym clothing. Don't focus only on wages per hour.

Calculate your total landed cost for both countries:

- Direct costs : Fabric, trims, labor, packaging

- Logistics : Freight, customs, warehousing

- Hidden expenses : QC inspections, sampling rounds, material delays

- Tariff impact : China faces 20% combined US tariffs vs Vietnam's 10%

Set cost criteria at 40-60% of your total decision matrix for price-competitive brands. Building a premium technical brand? Drop cost to 25-35% . Raise quality and innovation criteria instead.

Speed-to-Market Requirements

Map out your critical path timeline . Track from design approval to retail availability.

China works for speed-dependent models : Fashion-forward activewear that changes each quarter. Technical innovations need 3-4 sampling rounds . Brands face tight seasonal windows . Missing launch dates kills sales.

Vietnam fits predictable cycles : Core basics with few design changes. Brands accept 80-140 day production timelines . Orders get planned 4-6 months ahead . No reactive changes needed.

Give speed factors 10-30% weight . Base this on how often you launch new designs. Factor in how much revenue you lose per week of delay.

Risk Tolerance Assessment

Test your margins under real disruption scenarios:

- Currency swings : Model ±10-20% FX moves against your operating currency

- Tariff shocks : Add +5-10% unexpected duty increases

- Logistics failures : Factor 2-4 week shipping delays

- Quality issues : Budget 5-15% defect rates on first production runs

Managers choose familiar countries even when data points elsewhere. That's behavioral economics at work. Does your team know Chinese suppliers better? Factor that comfort into your risk scoring.

Vietnam has higher material dependency risk . It relies on Chinese fabric imports. China faces geopolitical uncertainty . This could trigger sudden policy shifts. Neither option is risk-free.

Set risk criteria at 15-30% . This depends on your financial runway. Bootstrapped startups? Use higher risk weight. Well-funded brands? Use lower.

Production Capability Match

Score each country 1-10 on what your specific products need:

Technical construction needs:

- Seamless knitting: China 8-10 , Vietnam 5-7

- Bonded seams: China 9-10 , Vietnam 4-6

- Four-needle flatlock: China 9-10 , Vietnam 7-8

- Basic cut-and-sew: Both 8-10

Material innovation access:

- Custom fabric development: China 9-10 , Vietnam 3-5

- Performance treatments: China 8-10 , Vietnam 5-7

- Sustainable materials: China 7-9 , Vietnam 6-8

Give capability criteria 15-30% weight . Use higher weight for technical boundaries. Use lower for standard gym wear designs.

Market Access Strategy

EU-focused brands get big advantages with Vietnam's EVFTA agreement. 99% of tariff lines eliminated by 2027 . That means real cost savings at scale.

US market focus favors Vietnam a bit on tariff structure. Both countries face political uncertainty in 2025.

Figure out what percentage of target customers you can reach within 48-72 hours from each location. Proximity matters less for planned inventory. But it kills direct-to-consumer rapid replenishment models.

Your Scoring Matrix in Action

Startup athletic brand (5,000 units/quarter, testing market fit):

- Cost: 50% weight → Vietnam 7/10 , China 5/10

- Speed: 15% → China 8/10 , Vietnam 6/10

- Risk: 20% → Vietnam 7/10 , China 6/10

- Capability: 10% → China 9/10 , Vietnam 6/10

- Market access: 5% → Vietnam 8/10 , China 7/10

Vietnam total score: 6.9 | China total score: 6.0 → Choose Vietnam

Established performance brand (100,000 units/quarter, technical innovation):

- Cost: 30% → Vietnam 7/10 , China 6/10

- Speed: 25% → China 9/10 , Vietnam 6/10

- Risk: 15% → Vietnam 6/10 , China 6/10

- Capability: 25% → China 10/10 , Vietnam 5/10

- Market access: 5% → Vietnam 7/10 , China 7/10

China total score: 7.5 | Vietnam total score: 6.3 → Choose China

Run sensitivity analysis by shifting your top two criteria weights ±10%. Does your preferred country stay in the top 2 positions across scenarios? That's your resilient choice. Do rankings flip hard? You need dual-sourcing or deeper research before committing.

The smartest gym clothing brands don't pick one country forever. They match manufacturing location to product line complexity . Basic tanks and shorts? Vietnam handles those. Technical seamless sports bras? China produces them. Your chain can split across countries instead of forcing an either/or choice.

Real Buyer Case Studies: China vs Vietnam

Three real companies show how China-Vietnam manufacturing decisions play out with actual money on the line.

The LED Lighting Pioneer: Neo-Neon's Vietnam Bet

Neo-Neon Lighting jumped from Hong Kong/China operations into Vietnam in two stages. 2011 revenue hit $15,000 . The next year dropped to $3,000 as they adjusted their approach.

The context mattered. Vietnam imported 99% of LED lighting from China between January-November 2014. China's total LED exports to Vietnam exceeded $900 million that same year. Vietnam became China's third-largest LED market after the US and Russia.

Neo-Neon understood the math. They set up near their Chinese suppliers. Vietnam's government pushed energy-saving lamp policies. Belt and Road infrastructure support made logistics easier. Being close to Chinese suppliers kept material costs low. Vietnamese labor cut production costs.

The lesson : Enter a developing market where your home country already dominates supplies. You get cost advantages. Quality and availability stay strong.

The Dual-Operation Model: Kenvox's Integrated Network

Kenvox runs silicone and plastic molding across two countries at once. China handles raw materials and equipment sourcing . Their Vietnamese subsidiary sits on the northern border near Samsung and Foxconn facilities.

This split works because they transfer production lines between locations with ease. Downtime stays minimal. Costs drop through Vietnamese labor rates. But they protect IP and maintain quality control through Chinese oversight.

Their clients? US and Canadian buyers who need lower costs without quality compromises. Kenvox built this integrated network over the past decade . Their flexible operations let them shift production based on tariff changes, material costs, or client delivery needs.

The takeaway : You don't pick one country and stick there forever. Smart manufacturers run parallel operations. China sources and develops. Vietnam produces and puts things together. Both locations play to their strengths.

The Trade War Migration: 2019's Mass Factory Relocation

Trade tensions triggered the biggest manufacturing shift in modern history. Q1 2019 foreign investment in Vietnam jumped 86.2% to reach $10.8 billion . Chinese investors controlled about 50% of that capital.

Real estate told the real story. Factory lease sales in the first 8 months of 2019 exceeded the previous 8 years combined . Google moved Pixel production to Vietnam. Apple and Foxconn started exploring Vietnamese facilities. Samsung, LG, and Nike already operated there with 50%+ of their products coming from Vietnamese factories.

But this wasn't a complete China exit. Most companies kept Chinese operations for complex components. Vietnam handled final production and simpler manufacturing tasks.

Global brands made Vietnam their production hub : Nike sources over half their products there now. Samsung employs 100,000+ workers making smartphones. IKEA, H&M, Zara, and Adidas all expanded Vietnamese operations for apparel and footwear.

The limitations showed up fast. High-tech precision work like automotive parts and semiconductors still lags behind Chinese capabilities. Vietnam excels at electronics production and furniture. They struggle with advanced manufacturing that needs specialized equipment and deep technical know-how.

The pattern : Brands spread out to manage tariff risks. They kept China for R&D, complex components, and rapid prototyping. Vietnam became their volume production location for standard products. Your gym clothing strategy can follow this blueprint.

2025 Industry Trends & Future Outlook

Manufacturing gym clothing in 2025 runs on AI and data analytics more than thread and fabric. China and Vietnam both feel this shift. But they move at different speeds. This changes how you source your products.

AI transforms factory floors right now . Industrial manufacturers adopted AI tools in 55% of their operations as of late 2024. The global AI market jumped from $134 billion in 2023 to $184 billion in 2024 —a $50 billion single-year surge . That's not hype. That's production reality. It affects your gym wear orders today.

Chinese factories lead AI use in garment making. Predictive maintenance cuts machine downtime before problems stop your production. Tesla's Gigafactories proved this works: 30% cost reduction and 40% efficiency gains between 2020-2024. Top Chinese sportswear facilities use these same systems. They run knitting machines, cutting tables, and quality control cameras.

Vietnamese manufacturers sit 2-3 years behind in AI adoption. Tier-one export factories invest in automation. But most facilities still use manual processes. This gap hits your lead times and consistency harder in 2026-2027.

Data analytics reshapes demand forecasting . The market hits $132.9 billion by 2026 growing at 30.08% each year . Smart suppliers use real-time data to predict fabric needs. They adjust production schedules and cut waste. Chinese manufacturers get better analytics tools. They respond faster to your order changes or seasonal demand shifts.

Vietnam's analytics capability grows fast. But limited ties with upstream material suppliers create visibility gaps. Your Vietnamese factory might forecast well. But if their Chinese fabric supplier doesn't share that data flow, lead times stay unpredictable.

Edge computing changes quality control . By 2025, manufacturers process 50% of data at the edge —right on the factory floor instead of distant cloud servers. Defect detection happens in real-time during production. Chinese facilities use camera systems that catch stitching errors, fabric flaws, and color mismatches before your order gets packed.

The future splits three ways based on product complexity. Standard gym basics move to Vietnam's lower costs . Technical performance wear stays in China's innovation hub . Hybrid models emerge : China makes performance fabrics and complex parts. Vietnam handles cutting, sewing, and putting pieces together. Your 2026 sourcing strategy needs all three approaches ready—not just one country locked in.

Conclusion

China vs Vietnam gym clothing makers - don't look for the "best" choice. Find what works for your brand. China gives you massive production capacity , top-grade performance fabrics , and good prices for bulk workout clothes orders over 3,000 units. Vietnam wins with lower athletic wear costs for mid-sized batches, quicker gym wear turnaround , and better tariffs for US shipments.

Three factors matter most: order size, budget room, and where you position your brand. Startups do well with Vietnam's lower activewear factory minimums and personal service. Bigger brands use China's setup for detailed fitness apparel custom work and growth potential.

What should you do now? Get samples from 3-5 makers in both countries. Check their sportswear OEM work , how fast they respond, and real quality - not empty words. Want proven suppliers? Contact our sourcing team for maker suggestions that fit your needs. The right factory partner does more than make clothes - they help your brand grow faster.