Finding the right running jacket manufacturer can make or break your athletic apparel business. You might be launching a boutique running brand. Or scaling up your activewear line. Maybe you need a reliable OEM partner who gets technical sportswear. The stakes are high in 2025.

The global performance running wear market has tons of suppliers claiming premium quality. But few deliver weather-resistant jackets that combine breathable tech, moisture-wicking design, and the durability serious runners need. I've spent months analyzing production capabilities, certifications, minimum order quantities, and real client feedback. This cuts through the marketing noise.

This breakdown reveals eight manufacturers worth your time and investment. Some specialize in lightweight running gear innovation. Others handle large-scale activewear production. You'll discover which suppliers excel at small-batch customization. You'll see who leads in reflective running apparel technology. Plus, you'll learn what questions to ask before signing that first purchase order.

No fluff. Just actionable intelligence to help you source smarter and faster.

Berunclothes - Leading OEM/ODM Custom Sports Jacket Manufacturer

Berunclothes solves one key problem: small-batch custom orders with strong quality. Most manufacturers require 1,000-unit minimums. This China-based supplier works differently. Shopify sellers, Amazon entrepreneurs, and new activewear brands get flexible order volumes.

One-Stop Manufacturing Infrastructure

The company uses a smart network model. Their own factory handles core production. Vetted partner facilities and material suppliers support this—built over 10+ years in technical sportswear. You skip the hassle of managing multiple vendors for fabric, printing, and assembly.

You work with one team. They handle moisture-wicking fabric selection. They build windproof jackets. They package the final product.

Design-to-Production Speed Matters

Berunclothes stands apart from typical OEM suppliers. Their 10-person design team turns ideas into ready samples fast. Send them a sketch or reference image. They create technical specs. They pick the right breathable athletic materials. They suggest the best Printing methods for reflective running gear.

The timeline? Design-to-production completes in one week for rush orders. That's the full cycle—not just samples.

No design team? No problem. The service is free with orders . Color matching, logo placement, hang tag design—all covered.

Quality Credentials That Open Doors

Selling to European or North American retailers? Certifications matter. Berunclothes holds OEKO-TEX Standard 100 for textile safety. They have BSCI, WRAP, SEDEX , and ISO compliance. Third-party auditors like SGS and Bureau Veritas verify these.

These aren't just marketing badges. Buyers ask about factory compliance and material safety docs. These certifications protect you.

Customization Without Complexity

The product range covers full performance running wear: jackets, hoodies, jerseys, base layers, accessories. Their technical skills show real depth. They do sublimation printing for bright, wash-resistant graphics on lightweight running gear. They source quality materials—though specific waterproof ratings and DWR coating grades aren't listed on their site.

You control branding your way: custom labels, swing tags, bags, even branded carton packaging for your activewear manufacturing line.

Who Benefits Most

Berunclothes works best for budget-conscious startups and small-to-medium brands . Launching weather-resistant jacket collections? Expanding your line? This fits. Testing new designs? Entering niche running communities? Need OEM sports apparel flexibility? Their model delivers.

Ask specific questions upfront. MOQ thresholds, waterproof specs, production capacity—get clarity on these in initial talks. The website shows service range more than detailed technical data.

ASICS - Global Manufacturer of Running Apparel at Scale

ASICS holds a strong position in the global running apparel market. They compete with Nike, Adidas, Under Armour, PUMA, and New Balance—the top names in performance running wear. This isn't a small niche player. ASICS runs large-scale athletic manufacturing.

Market Position and Global Reach

The numbers show clear expansion. The global running apparel market hit USD 16,012.1 million in 2024 . Projections push this to USD 25,053.7 million by 2033 —a 5.1% compound annual growth rate . Other data shows an even bigger picture: USD 90.44 billion in 2025 climbing to USD 131.89 billion by 2030 at 7.84% CAGR .

ASICS grows across key territories. Asia-Pacific leads growth at 8.32% CAGR through 2030 —the fastest regional expansion worldwide. North America holds the largest gear market share at about 31.1% . Europe leads in apparel sales .

Why This Scale Matters for B2B Buyers

Three market forces drive this growth. Global fitness participation jumps 15% each year . Sports apparel spending rises 20% year-over-year . Most relevant? 40% of consumers now want eco-friendly materials —a requirement that separates capable manufacturers from the rest.

ASICS works in this competitive space every day. Their production systems make weather-resistant jackets, breathable athletic outerwear, and moisture-wicking fabric. Smaller suppliers can't match these volumes. You need consistent quality across thousands of units? Established infrastructure beats marketing claims.

The company excels in technical sportswear. Trail running and ultramarathon gear show this strength—segments that need advanced lightweight running gear and real windproof running jacket performance. Planning serious activewear manufacturing partnerships? ASICS brings proven scale to B2B partners.

Patagonia - Pioneer in Sustainable Eco-Friendly Sports Jackets

Patagonia doesn't make jackets for everyone. They put the planet first, customers second. This approach built them a billion-dollar business.

Green Technology That Performs

The Storm Racer jacket proves sustainability can meet real performance needs. This three-layer Gore-Tex shell weighs just 7.2 ounces . The waterproof breathable membrane skips PFC-based DWR coatings. These fluorochemicals poison water supplies. Patagonia spent 20 years removing PFAS and PFC from production. Most brands still use these chemicals. Green options cost more and need tighter quality checks.

Their Houdini windbreaker weighs 3.7 ounces of recycled nylon. It folds into its own pocket. By 2025, Patagonia will stop using virgin polyester . Every jacket uses post-consumer waste. Recycled bottles, fishing nets, and factory scraps go into each piece.

Materials Based on Real Data

Since 1994, Patagonia's 100% Synchilla® fleece jackets have used recycled plastic bottles. Their 2023 Fall wool collection had 89% recycled wool . This one choice cut over 3.5 million pounds of CO₂ emissions .

The 2025 goal: organic or recycled cotton, polyester, and nylon . No virgin synthetics. No conventional cotton pesticides.

Here's the tech behind their green TPU three-layer fabrics:

Performance Metric | EcoFlex-3000 | Traditional PU | Test Standard |

|---|---|---|---|

Breaking Strength (Warp) | ≥380 N/5cm | 320 N/5cm | GB/T 3923.1 |

Tear Strength | ≥85 N | 60 N | GB/T 3917.2 |

Abrasion Resistance | ≥20,000 cycles | 12,000 cycles | GB/T 21196.2 |

Peel Strength | ≥12 N/3cm | 8 N/3cm | FZ/T 01010 |

Environmental Metric | Value | Notes |

|---|---|---|

Recyclability Rate | ≥90% | Physical recycling |

Global Warming Potential | 3.2 kg CO₂-eq/kg | 38% reduction |

Moisture Transmission | 850 g/m²·24h | Exceeds PU |

Their process uses heat compression at 160-180°C and 2.5-4.0 MPa pressure for 30-60 seconds . This bonds layers without toxic glues.

Supply Chain You Can Track

Fair Trade Certified™ labels show up on Patagonia gear. Not just marketing talk - real third-party checks. Their Worn Wear program collects 20,000 pounds of used clothing each year . That's about 20,000 R2 jackets . They repair 40,000 items . Recycled fabrics get tested like virgin materials. No shortcuts.

This isn't just talk. Replace 10 billion square meters of old materials with their green TPU each year? You cut 2.6 million tons of CO₂ . You save 17 million cubic meters of water .

Products Built for Pros

The Synchilla® Snap-T fleece ($109) uses their own recycled materials. Warm, light, breathable. Their down jackets and fleeces? Patagonia created modern technical fleece. Their $109-299 prices show real green costs. Not fake "eco" markups.

Premium picks include Gore-Tex ski shells with PrimaLoft fill. Built for mountain climbing and hard use. The High Reach cut gives full shoulder movement for technical climbs. Presidents like Clinton wear Patagonia. Everest climbers do too.

Working With Patagonia

Patagonia's MOQ starts around 500+ pieces for joint projects. Direct partnership details stay private. They share fleece tech and recycled production methods with brands that care about green standards. You don't just buy factory time. You commit to their material standards and testing that refuses easy fixes.

Plan for 30-45 day lead times . Sometimes longer. Recycled materials take more time to source. Turning used bottles into technical fabric needs more work than buying new polyester. Green TPU production runs from extrusion foaming (0.1-0.5mm cell size) through multi-layer bonding (1.8-3.2m width) to cooling. You can't rush this without losing quality.

This brand serves companies focused on green-minded runners, outdoor pros, and buyers who pay for real sustainability. Not discount shoppers. Not fast fashion.

Inov-8 - UK Specialist in High-Performance Breathable Sports Jackets

Inov-8 builds jackets for runners who hate carrying dead weight. The brand started in the UK's Lake District in 2003. They focused on trail running gear that moves fast and breathes hard. Their jackets don't try to do everything. They do one thing really well: keep you warm during high-output mountain runs without turning into a sweat trap.

Pertex Quantum Air Shell Technology

The Performance Hybrid Jacket uses Pertex Quantum Air as its outer shell. This fabric choice matters more than most spec sheets admit. Pertex shows up in gear from Montane, Rab, and other serious UK outdoor brands. It delivers three things at once: extreme lightness, wind resistance, and moisture vapor escape.

This isn't a waterproof hard shell. Think of it as water-resistant protection for light rain . Heavy downpours? You'll need an extra layer. For typical trail conditions—drizzle, mist, brief showers—the fabric handles it. Plus, it lets your body heat escape.

Body-Mapped PrimaLoft Active Evolve

Here's where Inov-8's approach gets smart. They use PrimaLoft Active Evolve insulation , but not everywhere. The body-mapped design puts warmth where you need it: head, neck, shoulders, upper arms, torso, and back . Your high-heat zones? Left open.

Stretch panels under the arms create ventilation highways. Push uphill at threshold pace? Those panels dump excess heat. The insulation stays light even when damp. Your core stays warm. Your arms move with ease. The system balances warmth against breathability instead of choosing one.

Pack-and-Go Design

The jacket stuffs into its own pocket. Toss it in your running vest, waist pack, or backpack. Pull it out at ridge line if the wind picks up. This packability matters for ultramarathon runners and mountain athletes . They count grams and pocket space.

The insulated hood folds down into a protective collar . Don't need head coverage? Just fold it down. One piece, two configurations. Less gear in your pack.

The Thermoshell Pro Alternative

Need more protection? The Thermoshell Pro Insulated Jacket 4.0 steps up. It's made for extreme mountain conditions and multi-day ultra races . Inov-8 markets this as windproof and water-resistant —not waterproof. Same philosophy: breathability over total weather sealing.

Looking for specific technical data? Inov-8 doesn't publish fabric weight, breathability ratings, or waterproof columns on public pages. Ask their B2B team for manufacturing specs, MOQs, and customization options.

Who This Fits

Inov-8 works for brands targeting serious trail runners and mountain athletes . Not casual joggers. Not fashion-forward streetwear. Your customers run in bad weather. They move hard. They need lightweight running gear that performs under load without constant care.

The UK heritage and Pertex partnerships signal quality. The body-mapped insulation shows smart engineering. But do your homework on production capabilities, lead times, and whether their minimums match your order volumes.

Montbell - Japan Precision Ultra-Lightweight Manufacturing

Montbell cuts away everything you don't need. Their "Light & Fast" design philosophy? It's not just marketing. It's pure engineering discipline. Since 1975, this Japanese brand built its name on one goal: max function at min weight. Zero extra grams. Zero durability trade-offs.

Precision Manufacturing Behind the Weight Reduction

The Tachyon Hooded jacket shows what Montbell can do. They use Toray Dermizax EV membrane tech. This is a special polyurethane film that moves 8,000–15,000 g/m²/24h moisture vapor . Testing meets JIS L 1099 B1/B2 standards . Waterproof rating? ≥10,000 mmH₂O static pressure . That's high-end mountaineering shell territory, not casual running gear.

Their production process shows Japanese precision:

Base fabric prep with strict quality checks

TPU/functional membrane applied at 110–130°C, 0.6–1.0 MPa pressure, 15–30 seconds

Foam layer forms and shapes

Multi-layer thermal bonding

Cooling and stabilization phase

Precision cuts to reduce waste

Final check before packaging

PFAS-Free Fabric Innovation

Montbell leads the move away from fluorochemicals. Their new Dermizax EV membrane skips PTFE micropores completely. This allows PFAS-free DWR treatments . They use silicone, polyurethane, or wax-based options instead of old C6/C8 fluoropolymers.

Performance stays top-tier. Their water-repellent treatments hold ≥3–4 grade spray ratings (AATCC 22 / JIS L 1092 standards). After 20 wash cycles , the fabric still performs at ≥3 grade. Most cheap DWR coatings die by wash 5.

Accessible Performance Pricing

Montbell calls itself Japan's national outdoor brand . Pricing shows it. Their Wind Blast economic line uses fabrics rated at ≥5,000–10,000 mmH₂O waterproofing and ≥5,000–8,000 g/m²/24h breathability . Fabric weight? 80–130 g/m² . These specs handle everyday wear and moderate trail running. Not Everest climbs.

Cost savings run 30–50% below premium Dermizax EV lines . You lose some vapor movement and weather sealing. But you keep Montbell's build quality and sharp details.

B2B Manufacturing Considerations

Montbell works with brands chasing hardcore alpinists and ultralight fans . Japanese manufacturing means tight specs and higher costs. Lead times run longer than Chinese suppliers. MOQ details need direct contact. They don't share partnership terms online.

Ask about fabric certs, production capacity, and pattern changes for running cuts. Montbell's roots are in alpine climbing, not track sports. Check if their tech approach fits your product goals before you commit. This matters for long-term success.

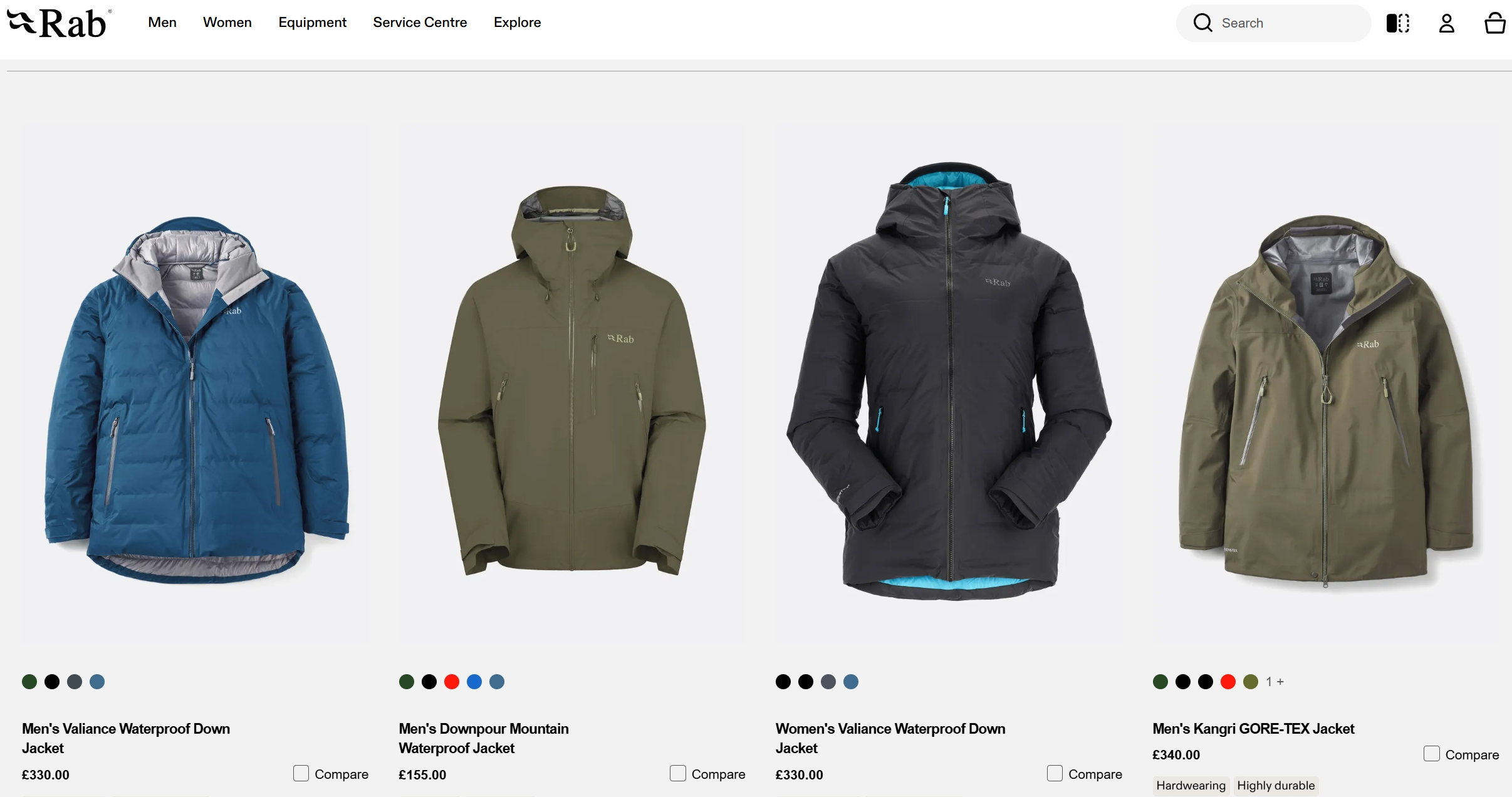

Rab - UK-based Professional Outdoor Waterproof Jacket Manufacturer

Rab protects climbers on Everest and trail runners in Scottish highlands. The same gear. The same standards. This UK outdoor brand treats every jacket the same - expedition-grade specs apply whether you're summitting K2 or running your local 10K in the rain.

Gore-Tex and Pertex Shield Form the Technical Core

Rab waterproof jackets rely on two major fabric systems: Gore-Tex and Pertex Shield. Each waterproof jacket comes standard with fully taped seams, waterproof zippers, and a durable water-repellent coating. The baseline for waterproofing? A hydrostatic head rating ≥10,000mm. This isn't a marketing number—it's the pass/fail threshold.

Pertex Shield Revolve fabric showcases their sustainable path. Recycled polyester fiber + waterproof breathable membrane + recyclable design. Performance without compromise. Eco-friendliness without discount.

The Phantom Strategy: Pack It, Forget It, Pull It Out

The Phantom Series lightweight waterproof jacket solves a specific problem: you're sweating on the climb, then suddenly hit by cold rain on the descent. Extreme temperature swings. You need a protective layer that packs into your pocket.

Products like the Cinder Phantom utilize 2.5-layer or 3-layer ultralight waterproof-breathable membranes. Self-stuffing design—the jacket packs into its own pocket. Clip it to your belt. Deploy it instantly. High breathability manages sweat evaporation. Consistent waterproofing blocks sudden showers.

Weight? Ultra-light. Pack size? Compresses to fist-sized. Performance? Meets Rab's mountain standards.

98% of Production is Now Fluorocarbon-Free

Rab has gone further than most brands in eliminating fluorocarbon chemicals. 98% of its product line is now fluorocarbon-free. No PFCs/PFAS. No traditional C6/C8 DWR coatings.

A small number of styles still contain residual fluorocarbon—in zipper materials or for specific DWR requirements. The Cinder Kinetic and some Phantom series outer fabrics fall within this 2%. They openly acknowledge this. The goal is complete elimination.

UK Factory Handles Premium Production

Rab's production layout is pragmatic. Its UK-based factory handles premium products: down sleeping bag filling, expedition gear manufacturing, and a care and repair center. Precision work remains domestic.

Most apparel and equipment? Contract manufacturing by long-term Asian partners. This isn't a cost compromise—it's a technical manufacturing partnership.

Supply chain metrics demonstrate quality management: 70% of production originates from Fair Wear Foundation-audited factories. 95% of production comes from long-term manufacturing bases. 55% of factories achieve A or B ratings for labor conditions.

Material Facts Programme Delivers Transparency

Rab operates the Material Facts Programme—publicly disclosing the recycled content percentage, chemical usage, and energy consumption data for fabrics. Renewable energy usage is tracked starting from Tier-1 factories.

You get RDS (Responsible Down Standard) certified down in all down products. The source is traceable and comes as a meat industry byproduct. P.U.R.E. Recycled Down and PrimaLoft Silver Insulation Luxe Recycled Synthetic Cotton are increasingly used in fill materials.

B2B Collaboration Considerations

Rab serves brands requiring genuine waterproof performance and sustainability certifications. The price point reflects technical investment—not an entry-level option. UK factory capacity is limited, primarily handling bespoke orders. Asian manufacturing partners handle volume production.

When inquiring about specific MOQs, lead times, or fabric customization options, clearly state your technical requirements. Rab does not compromise on product quality. Their standards are built on real-world mountain testing—from the Scottish Highlands to the Himalayas.

Brooks Running - Leading American Running Gear Brand

Brooks Running owns 25% of the U.S. running shoe specialty market . That's not hype. Circana data proves it: 11 straight quarters at #1 in adult performance running footwear. They don't make basketball shoes or lifestyle sneakers. They run. That's it.

The Numbers Behind the Growth

Revenue hit $1 billion in the first nine months of 2024 . Record numbers. Q3 2024 grew 17% year-over-year —the 9th straight quarter of growth . By Q2 and Q3 2025, global revenue jumped 19% YoY . That marks two straight all-time highs .

China revenue alone climbed 70% YoY in Q3 2024 . Brooks entered China in 2022. They went digital-first. They opened a 1,200 sq ft Shanghai flagship in September 2024. Plans show 30 Chinese stores by 2027 . Their Glycerin model hit #1 on Tmall its first week. The Chinese running market has 400 million regular runners (Alibaba Tmall data). Sports footwear spending hits 237.3 billion yuan in 2025 —up from 218.6 billion in 2023 . China's running shoe market grows at ~12% CAGR through 2030 .

Product Speed That Keeps Retailers Stocked

Brooks launched 8 new shoe styles in 2024 . Another 8 dropped in Q2 2025 . Updated Glycerin and Ghost models led the pack. These new styles saw 28% unit growth . E-commerce sales rose 16% in the first nine months of 2024 . They ship product. Retailers reorder. Runners buy again.

What Brooks Means for B2B Partners

Brooks proves one thing: focus wins. No basketball division. No tennis line. Just performance running gear. They build it on real research. Runner feedback shapes every design. Their operations handle volume— $1 billion in sales each quarter needs tight factory coordination.

Brands looking at OEM partnerships or activewear manufacturing deals can learn from Brooks. Technical know-how and market data fuel steady growth. They test fabrics. They measure how runners move. They ship consistent quality at big scale. That's what serious running brands aim for in 2025.

The North Face - Global Manufacturer of Large-Scale Insulated Jackets

The North Face makes insulated jackets at a scale few brands can match. They rank with Nike, Adidas, and Under Armour in global market reports. Not as a niche player—as a volume leader.

The numbers prove it: the men's insulated jacket market hit $3.5 billion in 2024 . It climbs toward $5.39 billion by 2031 at 6.0% CAGR . Kids' insulated jackets? $1.2 billion in 2024 . Projected to hit $2.315 billion by 2031 with 7.5% growth each year . The North Face holds serious share in both segments.

The broader outdoor apparel market shows the same trend. $57.31 billion expected in 2026 . Rising to $106.7 billion by 2035 —a 7.15% compound annual growth rate . The North Face operates as a top outdoor brand in this expansion. They handle manufacturing logistics smaller brands can't manage.

ThermoBall Eco: Synthetic Insulation That Works Wet

The ThermoBall Eco Hoodie shows where The North Face invests R&D dollars. This jacket uses synthetic insulation that copies down loft structure. The key advantage? It stays warm in wet conditions. Real down collapses in moisture. ThermoBall keeps trapping air.

The fill material uses 100% recycled polyester fibers . Standard across most production runs. Some specific batches may vary a bit. Shell fabrics use recycled nylon or recycled polyester with DWR water repellent treatment. The North Face commits to phasing out PFC/PFAS fluorochemicals . They favor fluorine-free DWR options. Industry testing data for PFAS levels in specific ThermoBall Eco batches isn't available to the public. Track official specs for current models.

Weight stays light: ~300-450 grams per jacket . Depends on size, gender cut, and production year. Fill weight runs 60-100 g/m² in most cases. Standard range for lightweight synthetic insulation layers. These aren't hard-shell expedition pieces. They're active insulation for changing conditions.

Supply Chain Built for Volume

The North Face operates under VF Corporation—a massive apparel conglomerate. Their manufacturing network covers multiple countries : China, Vietnam, Bangladesh lead production. Secondary facilities exist in Europe and Latin America. This isn't one factory. It's a coordinated global system.

Supplier awards prove they manage this well. A core supplier won The North Face Global Supplier of the Year recognition around 2016. This shows long-term partnerships. Performance reviews happen each year. Tied to quality and delivery timelines.

MOQ Reality Check

Public documents don't list exact minimum order quantities. Industry standards tell a different story. Large brands ordering functional outerwear and insulated jackets need 300-800+ pieces per color for big-scale production. Main collection styles? Batches can reach thousands to tens of thousands of units .

A fair estimate: The North Face expects ≥800 pieces per style from core suppliers for volume runs. Smaller test runs might go lower. Major seasonal launches go much higher. Confirm exact MOQs during B2B talks. Don't assume based on category norms alone.

Responsible Down Standard Leadership

The North Face helped create the Responsible Down Standard (RDS) . Then handed it to third-party certifiers like Control Union. Their down products carry RDS certification. This ensures traceable sourcing from farms that don't force-feed or live-pluck birds. Down comes as a byproduct of meat production, not primary harvest.

This matters for B2B partners entering European and North American markets . Animal welfare certifications unlock retail partnerships there. The North Face set the standard here. Other brands followed.

Who Benefits from This Partnership

Work with The North Face if you need proven large-scale manufacturing setup and strong sustainability credentials . Their supplier network handles massive volumes with consistent quality. Their material innovation fits 2025 market demands. Recycled synthetics, RDS down, PFAS-free treatments—all covered.

Expect higher MOQs than boutique brands. Expect strict quality standards. Expect lead times that reflect global coordination. But you get access to manufacturing systems built for billion-dollar outdoor apparel markets . Not makeshift setups that don't scale well.

B2B Procurement FAQ

Most buyers mess up before they send the first email. They think faster replies mean better deals. They see polite messages as real interest. Here's what works for sourcing running jackets from manufacturers in 2025.

How Do I Negotiate Lower MOQs Without Killing My Margins?

You have leverage with multiple suppliers. Contact 3-5 factories at the same time . Tell each one you're building an open supply chain. This cuts MOQs to 50% of original requirements . Manufacturers prefer a partial share over no business.

Check their FOB quote against your CIF landed cost average. Calculate it: total order value ÷ unit quantity = average unit price . FOB price higher than your CIF average? That supplier sees you as price-focused. Push for lower quantities first. Don't argue on unit cost yet. Volume flexibility beats pennies per piece at this stage.

What Should I Verify Before Placing My First Order?

78% of B2B buyers study just 3 suppliers deeply —even though they list more at first. Those three get serious review. Here's their process:

97% check your website first . Make yours load fast. Show production capabilities, certifications, and past client work at the top.

90% expect replies within 10 minutes . Set up auto-responses if you can't staff email 24/7. Confirm you got their message. Promise detailed answers within 4 hours.

81% of buyers complete 69% of their research before contacting you . They come with specific needs. Make sure their requirements reach 85% clarity before you quote.

One more thing: 60% of inquiries are just information gathering . Polite questions don't mean they'll buy. Track response patterns. Fast replies from multiple contacts? Check their order history via customs data or LinkedIn job titles with "Procurement." Real buyers show clear signals beyond nice emails.

How Does the Custom Design Process Work?

Buyers review 13 pieces of content before deciding: 8 from potential suppliers, 5 from third-party sources like reviews or industry reports. Video content and live online events boost quick purchase decisions by 131% . Post factory tours, tech spec videos, and fabric testing clips.

For sampling: target buyers looking for backup suppliers (Second Source strategy). Use customs databases to confirm their purchase volumes with current vendors. Search LinkedIn for their procurement team. Copy their exact search keywords for your sales outreach.

Bulk production? Set tiered pricing based on 10+ unit order patterns . A buyer issues an RFQ. A countdown starts. More competing suppliers = higher close rates . It sounds wrong, but data proves it. Buyers feel confident with multiple factories confirming it's doable.

What Happens If Quality Issues Arise?

Track response time, but don't mix up speed with satisfaction. Use NPS scores and feedback loops to measure real quality perception. Response time alone lies—some factories answer fast but never fix core problems.

For returns: monitor B2B order metrics by unit count and total spend, not just single transactions. Spot seasonal purchase patterns. Adjust your inventory buffers to match. 86% of deals stall at some point. Use CRM analytics to find why previous orders failed. Fix those friction points before the next buyer faces them.

How Should I Structure Payments and Trade Terms?

Email marketing delivers the highest ROI for B2B outreach. 45% of marketers use webinars for lead generation—host factory updates or material innovation sessions every three months.

Trade terms show buyer priorities. Compare FOB vs. CIF pricing : divide total value by quantity for average unit cost. Quote above CIF average? You've got a price-focused buyer who's not your ideal customer. They'll squeeze margins. Focus on brands that value reliability (42% decision weight) over price alone (23%) —McKinsey data confirms this split.

What Builds Long-Term Manufacturing Partnerships?

Break data silos. Connect CRM systems so sales and support teams share buyer interaction history. 67% of the buyer journey happens online before human contact. Sales cycles grew 43% longer in recent years. Reps spend just 28% of their week selling . Use sales analytics to spot deal bottlenecks and seasonal trends.

Framework agreements work with transparent forecasting from both sides. Share your production calendar. Ask for volume projections every three months. Lock in material costs for 6-12 month windows. Build trust through steady behavior, not just contract terms.

Conclusion

The running jacket manufacturing landscape in 2025 rewards smart research. You might launch a boutique activewear brand with Berunclothes' flexible 100-piece MOQ. Or scale production with ASICS' industrial capacity. Maybe you'll align with Patagonia's sustainability standards. Your manufacturer choice impacts your market position and profits.

Smart buyers know performance running wear needs more than cost comparisons. Check technical capabilities like moisture-wicking systems and windproof construction. Look at certifications - Bluesign and OEKO-TEX matter. Partnership flexibility counts too. The manufacturers here offer proven solutions for different business models. Startups get nimble customization. Established retailers get consistent volume.

Your next move : Download our Supplier Selection Checklist. Then request samples from 2-3 manufacturers that match your needs. Need help matching your project with the right OEM sports apparel partner? Contact Berunclothes' consultation team. A profitable product line versus an expensive mistake? It comes down to asking the right questions upfront.

The best manufacturing partnerships start with informed decisions, not rushed ones.