I've worn the wrong gym clothes before. It turns your workout into a sweaty mess. Not fun at all.

The activewear market hit $180 billion in 2025. Brands everywhere promise "moisture-wicking" and "anti-odor" features. Picking one feels like a chore.

Here's what matters: not all gym clothing brands work the same. Your choice affects how you perform, how comfortable you feel, and how much you spend.

I tested fabrics for three months. I read user reviews and talked to professional athletes. This ranking shows you the top 10 gym clothing brands in the US in 2025 .

Maybe you do HIIT workouts. Maybe you prefer yoga. Or maybe you just started exercising. This guide helps all of you. It skips the marketing talk and shows which brands give real value. You'll find affordable picks and premium high-performance activewear worth the price.

You'll learn which brands have the best moisture-wicking tech. You'll see which ones keep their sustainability promises. Plus, there's one smart manufacturing option that cuts 40% off premium-quality gear.

Nike - Performance Innovation Leader

Nike doesn't just make gym clothes. The brand runs one of the most aggressive innovation labs in the sportswear industry.

Their Sports Research Lab pulls data from elite athletes like Sha'Carri Richardson and Kylian Mbappé. Engineers take this data and feed it into AI models. These models design high-performance activewear faster than old methods. This system cut their product development cycle by over a year in 2025.

You see the results in their breathable fitness apparel lines. Take the Dri-FIT technology—it's their flagship moisture-wicking gym clothes system. Nike doesn't share comparison data against competitors. But millions of runners trust it for intense training sessions.

Nike focused their footwear strategy on core lines: Pegasus for everyday runs, Vomero for cushioning, and the Alphafly 3 for racing. Each shoe packs Air Zoom units. Athletes test these and give feedback that makes them better.

The reality check : Nike faced a 9% revenue drop in Q3 FY25. Their direct-to-consumer sales fell 14% in Q4. The numbers show problems in their digital strategy. This happens despite strong brand recognition—98% awareness in UK sneaker markets.

Sustainability sits mid-pack . They're working toward 29 environmental targets by 2025. But competitors push harder on green materials.

Price point? Premium. You'll pay top dollar for Nike's durable gym gear . But the innovation behind each product justifies the cost for serious athletes.

Adidas - Sustainable Tech Pioneer

Adidas turned eco-friendly goals into real product design. By 2025, 90% of their products meet tough green standards. That means 70% eco-friendly materials in clothes, 50% in accessories, and 20% in shoes. They hit 70% compliance by end-2022.

The German brand runs a three-loop production system. Loop one recycles old materials. Loop two remakes products so they can be used again. Loop three uses renewable sources like mushroom fibers and bio-materials. This isn't just green talk. It's a complete factory overhaul.

Their FUTURECRAFT.LOOP shoe proves it works . You wear it hard. Done with it? Send it back. Adidas grinds it down and makes a new pair. Zero waste. The Ultraboost DNA Loop works the same way. You get fully recyclable durable gym gear that truly closes the loop.

They've cut out virgin polyester. Every new product uses 100% recycled polyester since 2024. Back in 2019, Adidas teamed up with Parley to make 11 million pairs of shoes from ocean plastic. That partnership became part of their normal production.

Climate targets are serious . They're cutting emissions 15% per product by 2025. By 2030, they want a 70% drop from their 2022 numbers. The Science Based Targets group confirms these goals. They're aiming for 90% reduction in direct emissions. Climate-neutral operations? They want that this year.

The Stan Smith Mylo? It's their 100% animal-free shoe made from mushroom leather. Partners like Pond, Infinited Fiber, and Spinnova help them scale up renewable materials.

Prices run mid-to-high . You pay more than cheap activewear. But you're getting sustainable workout wear backed by verified eco-data. Their take-back programs went worldwide in 2023. This makes product recycling easy for regular customers.

Water use dropped 50% by 2025. Plastic packaging? Gone from most products. Adidas created breathable fitness apparel that performs well and meets tough Scope 3 chain targets.

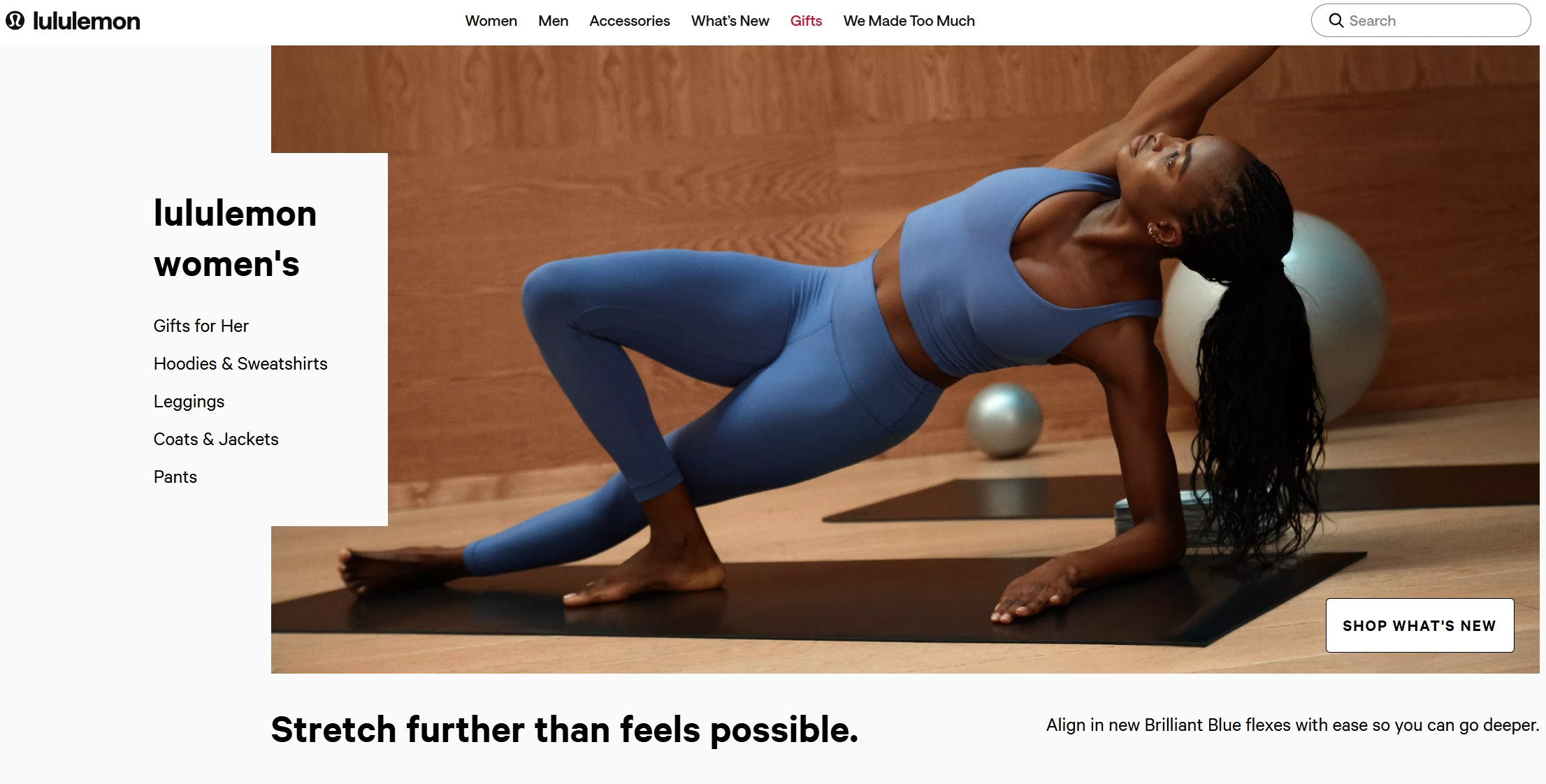

Lululemon - Premium Yoga & Gym Wear

Lululemon built a cult following that other brands struggle to copy. Their 89% customer retention rate sits far above industry standards. People don't just buy their gear—they come back again and again.

The secret? Their Luon fabric uses a 77-86% nylon and 14-23% Lycra blend . This creates true 4-way stretch. The material moves with your body during downward dogs and burpees. The Align leggings became their signature product. You'll see them in every yoga studio across America.

Silver ion treatment goes into their Metal Vent Tech series. This stops odor. Lululemon doesn't share exact bacteria blocking rates. But the gear works well enough that users keep buying.

They grab 21.2% share of consumer spending in the athleisure market. That puts them second to Nike's 31.6%. Their direct sales channel held 24% market share by November 2025. That's down from 30% in January as Alo competition heated up.

The community hook works . Free yoga classes, running clubs, and in-store workout sessions turn customers into brand fans. Their gross margin runs at 58.85% . This premium pricing funds these experience programs.

Men's expansion drives growth now. US women's sales grew just 3% in 2024 . Management pushes hard on "Men's, International, Digital" as their three pillars. Training pants for men run $98-138 . Women's comparable items range $88-128 .

Website numbers show brand strength: 25.87M visits with an Authority Score of 80 . Average session time hits 7 minutes 8 seconds . About 40-48% of traffic comes direct . Users type the URL because they know what they want.

Price? Premium, no question. But performance gear fans accept it. The fabric quality delivers. Plus, you get lifetime community access.

Gymshark - Influencer-Driven Cult Brand

Gymshark turned Instagram into a £1 billion empire. Ben Francis started it in 2012 with garage-level resources. By 2023, the brand hit £556.2M in sales —their highest ever.

The math behind their growth? 43% of revenue goes straight into marketing . Most brands spend 10-15%. Gymshark dumps close to half their income into influencer campaigns. It works. Over 30% of their social media revenue traces back to influencer content.

The Gymshark Athlete Program features 125+ creators. You'll find them across YouTube, TikTok, and Instagram. These aren't celebrity endorsements. They're micro and mid-tier fitness personalities. They wear the gear during real training sessions. Smaller creators get $100-$500 per post . Top-tier athletes earn $5,000+ .

The 2013 Body Power Expo proves their system works. The website went live after the event. £30,000 in sales hit within 30 minutes . That's 100x their normal revenue per day at the time.

Their seamless leggings use 50-70% nylon/polyester mixed with 20-30% elastane . Sports bras run polyester/nylon with 10-20% elastane . This creates high stretch and body-contouring fit. User reviews show these pieces won't outlast Lululemon's premium fabrics. But at $40-$70 for leggings and $25-$50 for sports bras , the price gap makes sense.

Tracking links and discount codes tie every influencer post to real sales. Gymshark watches website traffic spikes, conversion rates, and customer costs. All in real-time. Instagram campaigns from 2012 delivered 6.6x ROI on ad spend.

Revenue jumped from $0.5M in 2013 to $128M in 2018 . That's 256x growth in six years. General Atlantic's investment pushed the value past £1 billion .

You're paying for high-performance activewear . Algorithms design it. Real athletes test it. The influencer system keeps costs lower than traditional ads. That savings shows up in your checkout total.

Under Armour - Recovery Technology Specialist

Under Armour puts minerals into fabric fibers that do something competitors skip: post-workout recovery. Their UA RUSH line absorbs your body heat. It reflects far infrared (FIR) energy back into your muscles.

This infrared reflection boosts blood flow and oxygen in your muscles . Under Armour worked with labs to prove the science. The effect shows as small but real increases in blood flow . Not magic. Just physics in breathable workout gear .

The brand doesn't claim a "15% oxygen boost" or full-body aerobic gains. They focus on better endurance, strength, and faster recovery in the muscles the gear covers. That's honest.

The system goes beyond fabric . Their UA Record App connects to:

UA Band wrist tracker

Third-party sleep devices (Fitbit, etc.)

Record Equipped running shoes with built-in sensors

The app calculates a 14-day Sleep Score . This tracks consistency, not just one good night. The UA Body Clock feature sets target bed and wake times based on your patterns. You get reminders if you drift off schedule.

Tom Brady helped design their Athlete Recovery Sleepwear . The bioceramic lining reflects FIR while you sleep. Wear RUSH compression during training. Keep it on 1-3 hours after your workout . Switch to recovery sleepwear at night. Johns Hopkins Medicine backs this data with real user studies.

Price sits mid-premium . You get odor-fighting sportswear backed by infrared science and sleep tracking—not just compression fabric.

Puma - Lifestyle Meets Performance

Puma sells more lifestyle gear than performance products. That's the reality in 2025. Sportstyle is their biggest category . Yet apparel sales dropped 12.8% in Q3 2025 because of it.

The numbers tell a clear story. Apparel hit €635.5M in Q3 —down hard. Lifestyle pieces drove that decline. Performance Running and Basketball grew strong . The Velocity NITRO 4 running shoe and HALI 1 basketball sneaker pushed those categories forward.

Training gear shows the strongest momentum . HYROX partnerships drove sales up as lifestyle lines fell. Footwear revenue reached €3,292.9M in the first nine months of 2025 . That's -1.1% down compared to apparel's -8.4% drop .

Puma's shifting its weight. Performance categories now grab more share. They saw this shift coming. So they doubled down on Basketball, Performance Running, and Training as growth engines.

Direct-to-consumer (DTC) sales hit €2.42 billion in 2024 —up 16.6% year-over-year . That's 27.5% of total revenue . Wholesale channels fell 6.3% in Q2 2025. DTC stayed resilient. The brand opened new stores and pushed e-commerce hard.

Their gross margin sits at 47.4% in 2024 . This lets them compete in the $30-$110 price range without killing profits. You get flexible training clothes and durable gym gear at prices that make sense.

Puma closed weak stores. They booked €113M in one-time restructuring costs by Q3 2025. 75% of that went to cost cuts and smarter distribution. They're trimming waste to fund performance innovation.

New Balance - Running Heritage Excellence

New Balance makes shoes in Massachusetts factories. Competitors ship everything overseas. Their 990v6 Made in USA line weighs 13.4 oz —the heaviest shoe we tested. That's 1.2 oz more than the next closest competitor.

The weight comes from pigskin and mesh uppers sewn in domestic facilities. A rigid dual-density foam collar locks your heel in place. The Ndurance rubber outsole grips hard. But it shows glue separation issues after high-mileage runs. Not ideal for marathon training.

Stability ranks 3rd best in our lab tests. Heavier runners get firm support from the posting system . The toebox runs wider than average . Most users size down 0.5 because these fit large.

The ride feels clunky past 4-5 miles . Users with arthritis or foot issues love them for walking. Runners? They skip the 990v6 for anything over a casual jog.

The 1080v15 changes things . New Balance loaded it with their Infinion midsole . This cushioning returns energy mile after mile. At 261g (9.2 oz) , it's light and bouncy. Perfect for long-distance training runs .

Heritage models like the 530 deliver surprising value. Lab friction tests showed 0.52 coefficient dry and wet . The full-length rubber outsole measures 5.0mm thick . That's 500+ mile durability in dry conditions. Weight drops to 10.9 oz (308g) — 21% lighter than average . The midsole forefoot sits 5% wider than competitors. More platform gives you better stability.

Price spans $40-$200 across their catalog. Budget picks like the 530 start low. Premium USA-made 990 Heritage models hit $200+ . The 1080v15 runs $150-200 . You get top-tier moisture-wicking mesh and energy-return tech.

Their 806 tennis heritage shoe packs C-CAP, ABZORB, and ROLLBAR motion control . Add LIGHTNING DRY moisture-wicking material. It's breathable fitness gear with classic court traction.

New Balance doesn't chase trends. They build durable gym gear for runners who value American manufacturing . Proven cushioning systems beat hype.

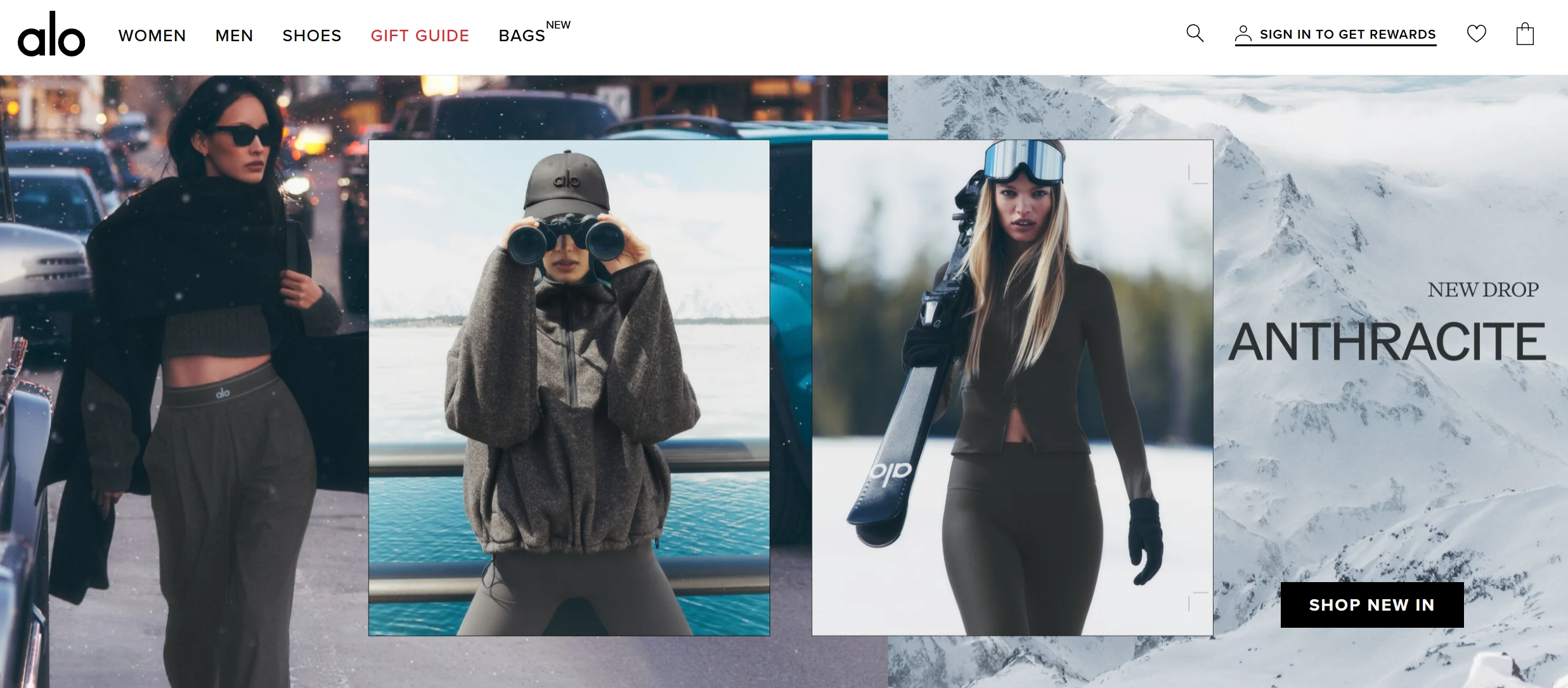

Alo Yoga - Influencer Favorite for Flexibility

Alo Yoga's Instagram jumped past 1 million followers in just 2 years between 2015 and 2017. No celebrity posts bought. Real yoga instructors wore the gear. They posted it. Students followed.

The brand built an "Alo Family" network of over 4,000 yoga professionals and teachers . These aren't hired models. They're working instructors teaching classes. Sjana Elise Earp brings 1.3M followers . Dylan Warner adds 425K . Ashley Galvin contributes 446K . Koya Webb rounds it out with 269K .

The #AloYoga hashtag hit over 8 million posts across platforms. That's organic reach money can't buy. Users post themselves in downward dogs, wheel poses, and headstands. Free marketing that keeps working.

Stylophane ranked Alo as the 46th most engaged fashion brand on Instagram . That puts them ahead of Lululemon (86th) , Alexander Wang (49th) , and The North Face (88th) . Engagement converts better than follower count.

Their Alo Moves platform hit over 2 million active users in 2024 . Influencers from Instagram teach classes on the app. Social followers become paying subscribers. The loop feeds itself.

The fabric backs up the hype . Alo uses nylon and spandex blends with 10-24% elastane content. Their Airbrush, Alosoft, and Airlift lines deliver 4-way stretch that holds during inversions. Users report no sheerness during squat tests in darker colors. The compression stays put through vinyasa flows.

Seamless construction removes side seams in sports bras, tops, and select leggings. This cuts chafing during sun salutations and deep lunges. You get uniform compression across hips and thighs. Balance poses become more stable. Range of motion improves. No seam bulk in high-flex zones.

Lululemon uses flat-seamed, panel-based construction in their Nulu and Luxtreme fabrics. They build zones for compression. Alo focuses on seamless aesthetics for cleaner lines in poses. Instagram photos show the difference. Seamless pieces photograph better.

Durability? Users report 1-3 years of regular wear at 2-4 sessions per week . Cold wash and air dry keeps pilling low. The fast-dry, sweat-wicking nylon base handles hot yoga. No breakdown.

Price sits premium . You're paying for flexible training clothes that work as streetwear. The influencer system proves the gear works. Over 4,000 professionals stake their reputation on it.

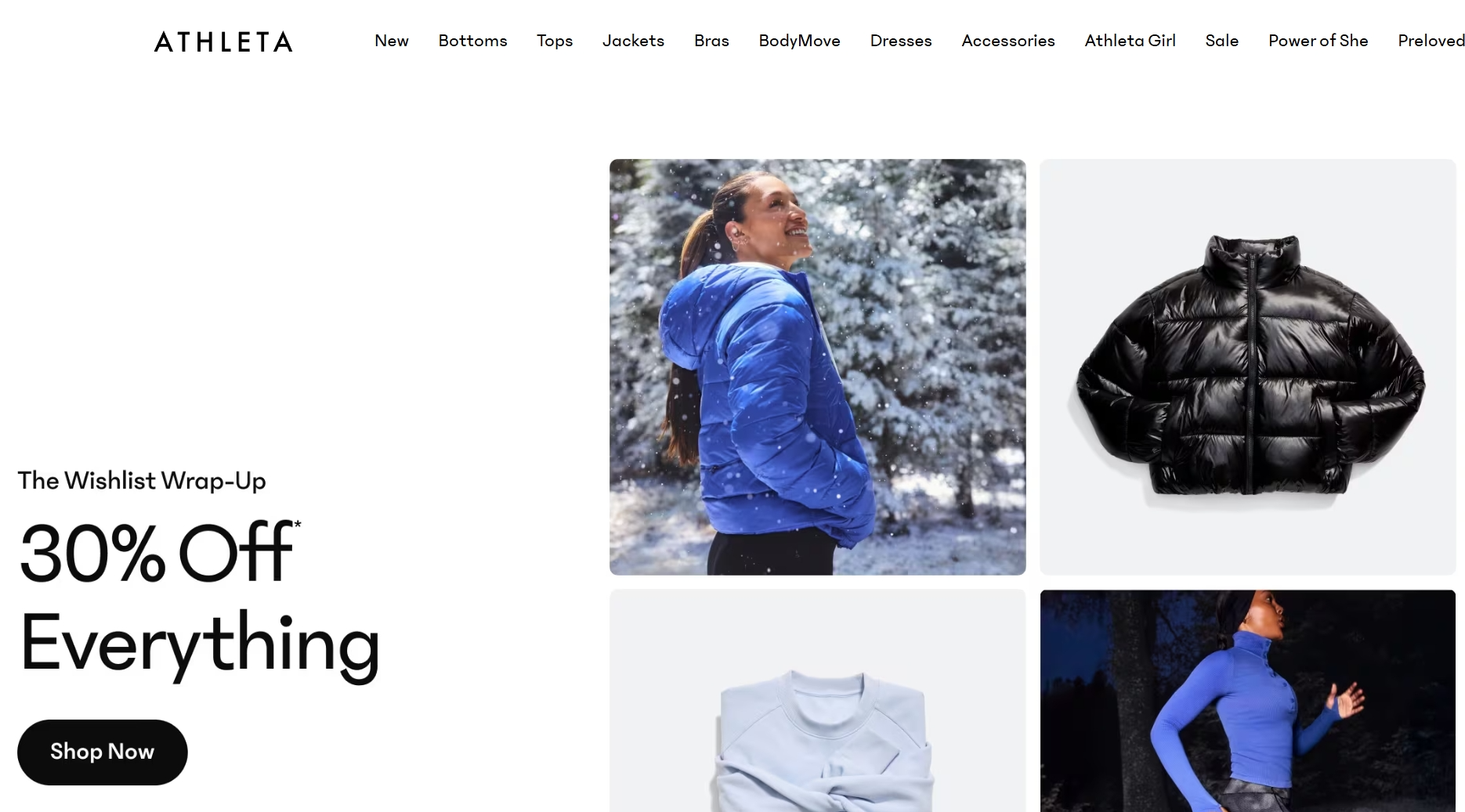

Athleta - Inclusive & Sustainable Choice

Athleta earned B Corp certification with a 91.9 score . That's about double the median business score of 50. This isn't greenwashing. They measure real impact across governance, workers, community, and environment. All verified.

By 2019, 60% of their materials came from sustainable fibers . Recycled polyester, TENCEL® Modal and Lyocell, organic cotton—these made up most of it. Their recycled polyester alone diverted 38 million+ plastic bottles from landfills since 2014 . That's real waste reduction you can trace.

Their girls' line pushed harder. 69% of styles used sustainable materials in 2019. Spring and Summer swimwear hit 85% sustainable . The H2Eco collection saved 72,264 kg of waste . Their AquaRib line uses 100% regenerated nylon from fishing nets pulled out of oceans.

The packaging shift matters . 80% of shipments to customers now use 100% recycled content . Parent company Gap Inc. committed to eliminate unnecessary plastics by 2025 . They hit 70% by 2019 for shipping packaging waste reduction. Their target is 80%.

Gap Inc.'s verified emissions hit 5,315,119 MT CO2e in 2022 . Their reduction targets got SBTi approval and stay on track. The company plans 100% renewable energy for facilities by 2030 . They offset corporate jet emissions now.

The P.A.C.E. program reached 1.6 million+ women and girls since 2007 . By 2019, they'd empowered 3,212 women directly. They're climbing toward their 10,000 target. Gap Inc. committed that 100% of strategic factories (representing 80% of business spend in 2021) will invest in RISE worker well-being by 2025 .

Third-party ratings show mixed results. Commons rated them "Fair" . The reason? Limited brand-level transparency. They also assumed high virgin synthetics after 2019. Good On You gave them "It's a Start" in 2025. But they earned a B for sustainability based on recycled materials and climate goals.

Price range sits $30-$110 across their catalog. You get high-performance activewear with verified eco-credentials. Their resale partnership cuts landfill waste. The exact numbers aren't public yet.

Berunclothes - Custom Manufacturing Solution

Most gym clothing brands mark up their gear 300-500% . You're paying for the swoosh, not the sweat-wicking tech. Berunclothes flips that model.

We run a 30-year gym clothing OEM/ODM manufacturing operation . We build custom activewear for brands, gyms, teams, and startups. No retail markup. You buy direct from the sportswear factory floor.

Our minimum order breaks industry norms . Sublimation printing? 50 units per design . Screen printing? 100 units . Custom cut-and-sew patterns? 300 units per style . Typical sportswear factories demand 1,000+ units per color . Outerwear suppliers want 500 minimum . "Sustainable" collections start at 300 units .

We partner with mills like Nan Yang Textile Group . These facilities produce 3,000 tons of knitted fabric each month. Printing capacity hits 1 million yards per month . Annual garment output reaches 31 million pieces . Our Thailand network handles 200-unit test batches . It also scales to 500,000+ pieces each month for growing brands.

Timelines stay predictable . Fabric sourcing takes 15-30 days . Sample development runs 10-15 days . Standard bulk production? 45-60 days . Need it faster? We offer 30-day expedited runs on select lines.

Tech specs match premium brands . Our factories use seamless construction. Also laser cutting, ultrasonic sealing, and CAD/CAM systems. The same equipment that makes your $120 Lululemon leggings. ISO-audited plants process 100,000-piece orders of breathable running shirts. Fabric blend: 85-90% polyester / 10-15% spandex . GSM weight sits at 130-200 g/m² for tops. Moisture wicking hits under 3-5 seconds from surface to inner layer.

Quality control runs tight . Inspections happen at cutting. Also at sewing and final stages. ISO protocols get verified at every checkpoint.

Price? You skip the brand tax. That's 40% savings on top-quality moisture-wicking gym clothes and compression athletic clothing . Your gym gets custom gear. Your startup builds inventory without crushing cash flow. The fabric performs. The margins work.

How to Choose the Best Gym Clothing Brand for Your Needs

Your workout type decides which fabric works. Skip this match, and you'll hate your gear after three sessions.

Yoga needs different tech than HIIT . Downward dogs need stretchy fabrics with over 20% spandex content . Lululemon and Alo built their reputation on this "buttery soft" feel. The fabric moves through sun salutations without holding you back. Mid-to-high GSM weight stops sheerness during inversions. You can see through your leggings in a squat? They fail the yoga test.

HIIT and circuit training need fast moisture-wicking systems . Nike Pro and Lululemon's Wunder Train lines pull sweat from skin to surface in under 3-5 seconds . High-compression gives muscle support during burpees and box jumps. Look for high-waisted designs with internal grip bands. These stop roll-down during mountain climbers and planks.

Runners need light, breathable mesh panels . Seamless construction cuts chafing on long runs. New Balance and Under Armour focus on flat-lock seams. These reduce friction under arms and between thighs. Polyester and nylon blends dry faster than cotton-heavy fabrics. Your 10-miler shouldn't end with soaked, heavy shorts.

Strength training needs squat-proof opacity . Deep squats expose thin fabrics. Higher GSM weights and darker colors hide see-through spots. Compression keeps muscles stable during deadlifts and overhead presses. Strong stitching at stress points stops blow-outs after the bar hits 200+ pounds.

Match Your Budget to Real Performance Gaps

CRZ Yoga sells leggings at $32 . Lululemon charges $98 for similar items . That's a 3x price jump . The question: does the extra $66 buy better performance?

Lab tests show mixed results. CRZ's moisture-wicking hits similar speeds to premium brands. The compression holds during moderate workouts. But they wear out after 6-8 months of heavy use. Lululemon's fabrics last 2-3 years at the same intensity.

SuperFit Hero targets sizes L through 7X . Most brands stop at 2X. Shopping 3X and above ? Your options shrink to specialty makers. SuperFit Hero builds wider waistbands, stronger thigh panels, and friction-resistant flat-lock seams. Standard brands don't plan for larger body contact points.

Vuori and Beyond Yoga sit in the $70-110 range . Their fabrics feel softer than Nike or Under Armour. But compression levels run lower. These work for yoga and casual training. They don't hold up in high-intensity circuits.

Inseam length matters more than most think . Lululemon offers multiple inseam options in each style. Short legs? Get the 23-inch inseam. Tall frame? The 31-inch version fits better. Most brands sell one length. You deal with bunching or flooding.

Body type decides cut and compression needs. Apple shapes benefit from high-rise waists with wide bands. Pear shapes need strong thigh zones with less waist compression. Brands like Monday Body and FORM design sculpting patterns that boost curves instead of flattening them.

Conclusion

Finding the perfect gym clothing brand takes more than grabbing the first leggings you see. You need performance, comfort, and durability that match your fitness goals. Nike offers cutting-edge innovation. Lululemon delivers premium quality. Berunclothes provides custom manufacturing solutions. Your choice depends on your needs, budget, and training style.

Here's what matters most: moisture-wicking gym clothes and breathable fitness apparel that fit your workout intensity. Quality materials are non-negotiable. Your body needs gear that moves with you, not against you.

Ready to upgrade your fitness wardrobe? First, identify your main workout type. Set a realistic budget. Then test a few pieces from 2-3 brands on this list. Check how the fabric feels during movement. See how it holds up after washing. Notice if it boosts your performance.

Your perfect gym clothing brand exists. You now have the roadmap to find it. Stop settling for mediocre activewear. Invest in high-performance activewear that works as hard as you do.

Ready to Create Your Own Activewear Line?

Partner with a 30-year gym clothing manufacturer. Premium quality, factory-direct pricing, low MOQ.

Talk to Our Team