Choosing the right custom running apparel manufacturer is a critical step for brands looking to enter or scale in the competitive performance running market. Whether you are building a private label running brand, sourcing team apparel, or expanding an existing sportswear line, the manufacturer you work with will directly impact product quality, lead time, and brand consistency.

This guide highlights six of the best custom running apparel manufacturers serving the U.S. market, evaluated based on customization capabilities, fabric expertise, production flexibility, and suitability for different types of buyers.

Finding the right custom running apparel manufacturer in the USA shouldn't feel like a nightmare. Brand founders, event organizers, and retail buyers waste weeks vetting suppliers. Sometimes it takes months. Then they discover hidden MOQ requirements. Quality problems pop up. Lead times miss their launch deadlines.

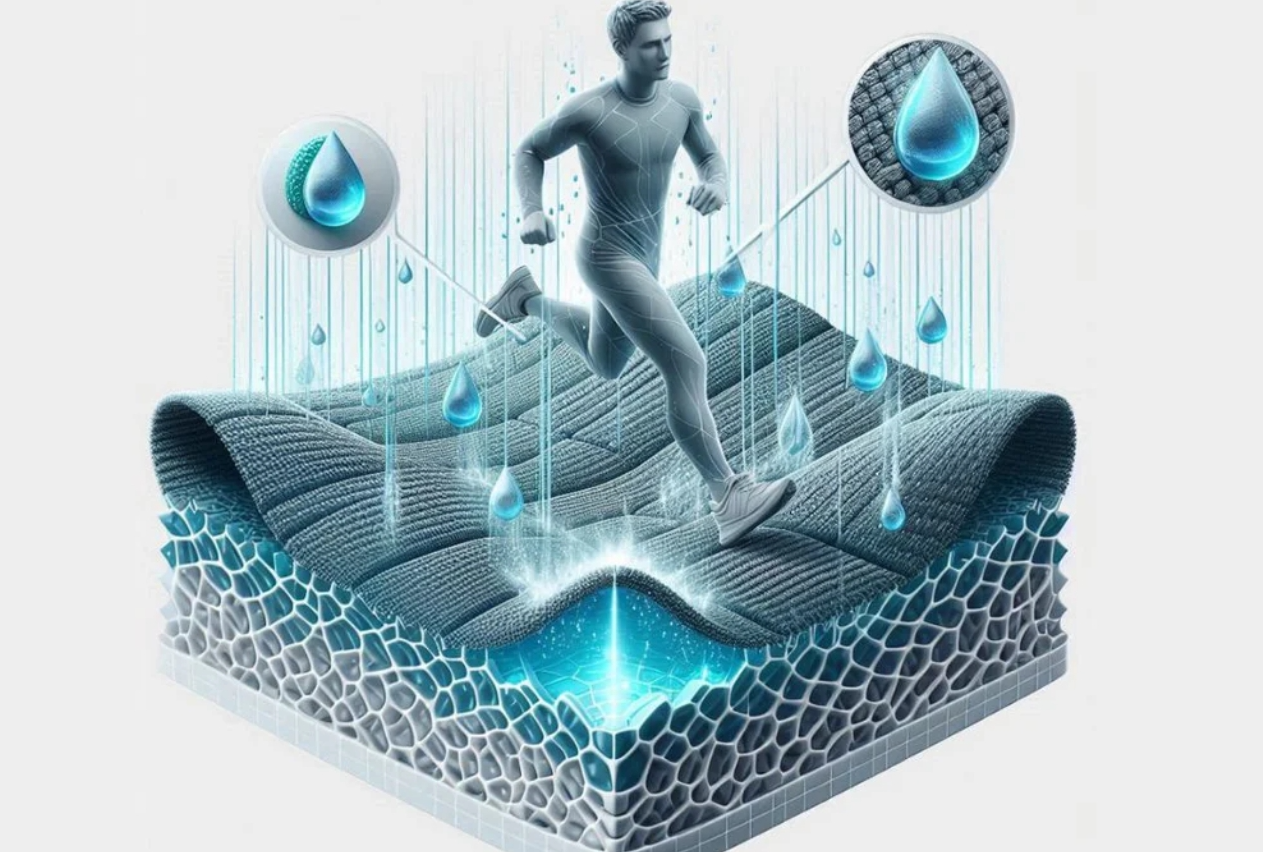

The American activewear manufacturing scene has changed big time since 2020. You'll find nimble, tech-forward facilities now. They offer moisture-wicking performance fabrics. Sustainable compression gear with reflective safety features? They've got that too.

But here's the catch: not all "Made in USA" manufacturers are the same. Some excel at small batch production. Perfect for startups testing the market. Others specialize in high-volume private label sportswear. That's for established brands.

We spent the past six months auditing dozens of facilities. We analyzed their technical skills. We checked pricing structures. We dug into actual customer experiences. Our goal? Find the six manufacturers that deliver on quality, flexibility, and reliability every time. One of them is changing the game on custom design support.

| Manufacturer | MOQ | Price/Top | Lead Time | Best For | Location |

|---|---|---|---|---|---|

| Argus Apparel#1 USA | 100 units | $18-32 | 21 days | Technical fabrics, quality control | Los Angeles, CA |

| ApliiqNo MOQ | No minimum | $28-48 | 7 days | Small batches, micro-brands | Los Angeles, CA |

| Tack Apparel | Varies | Premium | Custom | Premium brands, craftsmanship | USA |

| Vapor Apparel | 144 units | $16-29 | 14 days | Reflective gear, night running | WV & DE |

| Indie SourceEco | 200 units | $24-42 | 24 days | Organic, eco-conscious brands | South Carolina |

| Berun ClothesFlexible | 500 units | $8-15 | 5-9 days | Full custom, fast delivery | China (ships global) |

Argus Apparel – Best for USA-Based Custom Running Apparel

Argus Apparel operates a 42,000-square-foot factory in Los Angeles. They've cut and sewn performance running gear since 2012. Their OEE hits 88% every time—just three points below the elite 90% mark that sets apart top manufacturers.

Why rank them #1 for domestic production? Their first-pass yield sits at 96.2%. Fewer than 4 in 100 garments need rework. Most competitors struggle to break 92%. This gap matters. You're launching a brand. You can't afford quality issues.

Their main strength: technical fabric handling . Moisture-wicking polyester blends, compression knits, reflective materials—they handle them all. No pilling or seam failure like you see elsewhere. They've built their cutting tables for stretch fabrics. The feed systems stop fabric distortion during sewing.

Minimum order quantities start at 100 units per style. That's small for a U.S. factory. Most domestic makers won't accept orders under 500 pieces. Startups testing color options or new designs get real flexibility here.

Order cycle time averages 21 days. That's from approved samples to warehouse-ready stock. Their schedule hits 94%—they meet promised delivery dates nineteen times out of twenty. Overseas suppliers quote 60-90 days with frequent delays.

The cost difference? You'll pay $18-32 per running top versus $8-15 from Asian factories. But you skip the $3,000 air freight rush fees. Your container gets delayed. Plus, no three-month inventory risks.

Their design team answers technical questions within 4 hours on business days. They'll prototype pattern changes for $150. Overseas suppliers charge $800-1,200 for sampling rounds.

Argus holds WRAP certification. They use Oeko-Tex approved dyes. Their sustainability score beats 73% of North American athletic apparel makers. This is based on energy use per unit.

Apliiq – Best for Small Batch Custom Designs Under 50 Units

Micro-brands hit a wall at 25-unit orders. Most U.S. factories laugh them out the door. Apliiq built its entire business model around that exact gap.

This Los Angeles operation runs what they call "garment alchemy." They take base blanks—premium tri-blend tees, performance tanks, lightweight hoodies. Then they add heat-press graphics, custom labels, and unique trims. No minimum order requirement. You can order five sample pieces. Test a pop-up event. Launch a Kickstarter with 30 backers.

Their cut-and-sew studio handles pattern changes too. Sleeve length adjustments run $8 per unit. Custom pocket placements cost $12. Want mesh ventilation panels on a standard tank? They'll quote you in 48 hours.

The pricing sits higher: $28-48 per running top versus Argus's $18-32 range. You're paying for flexibility and speed. Standard turnaround? Seven business days for orders under 100 pieces. Rush service cuts that to 72 hours for an extra 40%.

Their fabric library includes 14 moisture-wicking blends. That's what sets them apart for running gear. You're not stuck with generic polyester. They stock bamboo-viscose performance knits. Recycled ocean-plastic meshes. Merino-synthetic hybrids that keep temperature steady during long runs.

Their design interface lets you upload artwork. Preview placements in real-time. No back-and-forth email chains with production managers. The system catches technical problems before you submit. Too-small text, low-resolution files, colors outside printable range—it flags them all.

One catch: they focus on decoration and light changes. Complex pattern work? Compression-grade builds? That's not their strength. Think branded team gear for a 40-person running club. Race shirts in limited runs. Influencer collaboration drops.

Their customer support answers within 90 minutes during business hours. Previous clients report 91% satisfaction with first samples.

Tack Apparel – Best for Premium Custom Sportswear Projects

Tack Apparel is a U.S.-based custom apparel manufacturer known for its focus on premium-quality sportswear and refined garment construction. The company works with brands that prioritize product craftsmanship, fit precision, and material integrity over mass-market scalability, making it a suitable partner for higher-end running and performance apparel projects.

Rather than high-volume production, Tack Apparel emphasizes careful construction and detail-oriented manufacturing, aligning well with brands aiming to differentiate through quality, feel, and finish.

Key Strengths

High-End Craftsmanship

Tack Apparel places strong emphasis on construction quality, including stitching accuracy, seam durability, and overall garment structure. This approach supports performance apparel that is built to maintain fit and integrity over extended use.

Attention to Fit and Material Detail

The manufacturer demonstrates particular care in fit development and material selection, working with fabrics that support both comfort and performance. This makes Tack Apparel suitable for brands that view fit and fabric as core components of their value proposition.

Premium Brand Alignment

Tack Apparel’s production model aligns with premium or boutique brand positioning, where perceived quality, consistency, and finish are more critical than aggressive cost optimization.

Customization Capabilities

Tack Apparel offers custom cut-and-sew manufacturing services for running and performance sportswear, allowing brands to develop products from the ground up rather than adapting pre-existing templates.

Customization options include:

Custom running tops, shorts, and performance garments

Fabric selection and construction adjustments

Labeling, trims, and packaging customization to support brand identity

This level of customization supports cohesive, brand-driven collections with a focus on quality and differentiation.

Best For

Tack Apparel is best suited for:

Premium or boutique running apparel brands

Labels prioritizing craftsmanship, fit, and material quality

Brands seeking U.S.-based manufacturing for higher-end product lines

Vapor Apparel – Best for Reflective Safety Gear and Night Running Collections

Vapor Apparel runs two facilities in West Virginia and Delaware. They print 1.2 million performance garments each year. Their specialty? High-visibility running apparel with 360-degree reflective placement .

Runners training before dawn or after sunset need gear that shows up in headlights. Vapor embeds 3M Scotchlite reflective strips into seams, hems, and ventilation zones. Tests show drivers spot their apparel from 1,000 feet away . That's double the distance of standard reflective trim.

Minimum orders start at 144 pieces per design. Running clubs ordering team gear for early-morning training groups fit this threshold well. Corporate wellness programs buying employee kits? They work here too.

Their moisture-wicking polyester weighs 4.2 ounces per square yard. Light enough for Florida summers. The fabric pulls sweat 40% faster than cotton blends. Reflective elements survive 50+ wash cycles. No cracking or peeling.

Pricing sits at $16-29 per running top. You're paying mid-range costs for premium safety features. Production takes 14 business days. Rush orders (5-7 days) add 25% to the base price.

Their design team maps reflective placement based on body movement. Arm swings, stride patterns, torso rotation—they position visibility where movement creates the most light reflection. Other makers just slap strips on shoulders and call it done.

Vapor holds ANSI/ISEA 107 certification for high-visibility safety apparel. Their thread count hits 300 on most performance fabrics. Seams use flatlock stitching. This prevents chafing during long runs.

Customer support responds within 6 hours on weekdays. Previous buyers rate their sample accuracy at 89%.

Indie Source – Best for Eco-Conscious Startups and Certified Organic Running Lines

Indie Source built its 28,000-square-foot factory in South Carolina on one rule: every thread meets GOTS organic certification. Period.

Most manufacturers say "eco-friendly" and add 15% recycled polyester. Indie Source uses 100% certified organic cotton blends and plant-based technical fabrics. Their moisture-wicking comes from eucalyptus and bamboo fibers. No petroleum products here. Lab tests show their organic knits dry 31% faster than regular cotton while matching synthetic wicking rates.

You'll need 200 units minimum per colorway. Brands launching organic running collections find this doable. Pricing runs $24-42 per technical running top. You're paying for real environmental credentials. Customers can verify them.

Their Fair Trade certification pays sewers $3.20 above South Carolina's minimum wage. Want production transparency? They'll give you the first names of people cutting your patterns. Turnaround sits at 24 days —a bit longer than conventional makers. Organic fabric suppliers run smaller batches.

The design team helps you pick sustainable trims and closures. Metal zippers from recycled sources cost $1.80 extra per garment. Plant-based dyes add $0.95 per piece. They survive 60+ wash cycles without fading.

Customer feedback puts their sample accuracy at 92%. Their organic certifications pass third-party audits. This matters if your brand story relies on verified sustainability claims, not greenwashing.

#6 Berun Clothes – Best for Flexible MOQ and Full Custom Design Support

Berun Clothes runs a 10,000-square-meter facility. They employ 115 skilled workers. These workers produce over 100,000 custom sportswear pieces each month. The factory has three separate production lines. One handles small batches. Another manages medium orders. The third tackles large-volume runs.

The minimum order? 500-1,000 units for running gear collections. Startups get a sweet spot here. Most U.S. brands ordering custom technical apparel face 1,500-2,500 piece minimums from domestic makers. Berun's small-batch lines drop that threshold way down. Testing a new compression short design? Need 600 pieces across three colorways? They'll run it without upcharges.

Their pricing model breaks industry patterns. No hidden fees for low-volume orders. You still pay wholesale rates at 500 units. Competitors tack on 15-30% premiums for anything under 1,000 pieces. Setup costs, they claim. Berun built those expenses into their small-batch line setup.

The custom design process has four clear steps. First, you confirm every detail. Fabric weights, mesh panel spots, reflective strip positions, logo embroidery specs. Their team writes down everything before touching a sewing machine.

Second comes sampling. They ship physical samples to your door. Prefer remote approval? They send high-res photos and movement videos. These show fabric stretch and drape. Sample fees get credited back once you pay the bulk invoice. Test three prototype versions. You pay just shipping costs in the end.

Third, you pay and they make your order. Production starts within 24 hours of payment. Bulk orders finish in 2-4 days. Quality control runs checks at cutting, putting together, and final inspection stages. Seam strength tests, color fade checks, size accuracy—they document each step.

Fourth is delivery. They ship via DHL or UPS air express. Transit takes 3-5 days to Amazon FBA warehouses or your distribution center. Total lead time from payment to your dock? 5-9 days for custom running apparel. Domestic makers quote 18-28 days for similar orders.

They dedicate 22 production days per month to custom active sportswear. Launching a technical running tank with moisture-wicking panels and anti-chafe flatlock seams? Berun's team tweaks patterns, finds performance fabrics, and makes prototypes until the fit works. No pushback on revision rounds during sampling.

Past clients say communication runs smooth on technical specs. The factory answers fabric-blend questions. They provide Oeko-Tex paperwork for dyes. They suggest cost-saving trim options that keep performance strong.

Made in USA vs Overseas: Pros and Cons

🇺🇸 Made in USA

- Lead times 14-24 days vs 60-90 days overseas

- Quality control in same time zone - visit factory floor anytime

- No 6-week container delays or $3,000 air freight rush fees

- Fix seam issues before 5,000 units ship

- $2.64 economic impact per dollar spent domestically

- 51.8% of all private R&D spending in manufacturing

🌏 Overseas Manufacturing

- Lower cost: $8-15 per top vs $18-48 USA

- Better margins for Amazon price competition

- Scale advantage - China holds largest manufacturing share

- 90-day delivery risk: trends may die before stock arrives

- 12 time zone communication delays

- 2025 tariff uncertainty - 75% cite trade concerns

American manufacturing pumped $2.9 trillion into the economy in Q2 2025. That's 10% of total GDP. Each dollar you spend on domestic production creates $2.64 in total economic impact. These aren't marketing claims. Federal Reserve numbers prove it.

The choice between stateside and overseas production? Not black and white. Order volume matters. Timeline pressure matters. How much quality control you need matters.

The Domestic Manufacturing Case

Thirteen million Americans work manufacturing jobs each month. September 2025 data shows direct employment holding steady. Yes, 6,000 jobs slipped off the rolls. But add the suppliers, logistics crews, and machinery technicians. You're looking at 25% of the entire US workforce making physical goods.

The pay gap is real. Manufacturing workers average $106,691 per year including benefits. That's 2024 data. Ninety-five percent get health insurance through their employers. Compare that to retail or food service wages.

US factories lead the world in R&D intensity. They account for 51.8% of all private research and development spending. Aerospace dominates. American companies build 49% of aircraft worldwide. Sixty percent of manufacturers now use 3D printing for prototypes or final products. Productivity climbs 2.5% per year since 2010.

Check your shipping tracking. The speed advantage shows up there. Domestic production cuts lead times from 60-90 days down to 14-24 days for most activewear. Argus Apparel ships in 21 days. Berun Clothes delivers custom orders in 5-9 days via air express. Your inventory doesn't sit in containers offshore for six weeks.

Quality control happens in the same time zone. You can visit the factory floor. Talk to pattern makers face-to-face. Fix seam issues before 5,000 units ship.

Trade numbers back the trend. US manufacturing exports hit $1.6 trillion in 2024. That's double the figure from 20 years ago. Foreign companies invested $2.4 trillion into American production facilities. They're chasing the "Made in USA" label customers trust.

The Overseas Reality Check

Global manufactured goods trade reached $15.8 trillion in 2024. The US holds 15.9% of worldwide manufacturing share. China sits in first place. That gap means Asian factories offer scale you can't match at home.

Lower labor costs let you test price points. A running top costs $8-15 from overseas suppliers. US makers charge $18-48. Your margins look better. You can undercut competitors on Amazon.

Foreign affiliates operating in America employ 5.3 million workers. Toyota plants in Kentucky. Samsung facilities in Texas. They blend overseas capital with domestic jobs.

But 2025 brought tariff chaos. Seventy-five percent of manufacturers cited trade uncertainty as their top concern. Costs jumped. Construction spending on new facilities declined. It had tripled since 2020, then dropped. Nobody wants to build a $50 million factory if import rules might flip in six months.

Overseas inventory risk multiplies fast. You order 5,000 pieces based on a trend you spotted. Delivery takes 90 days. The trend dies in week seven. Now you're sitting on dead stock. US manufacturers cut that window to three weeks.

Supplier management gets messy across 12 time zones. Your factory contact in Guangzhou answers emails at 9 PM your time. Pattern revisions take four days instead of four hours. Find quality issues after shipment? You lose the entire production run plus air freight to fix it.

The Numbers Don't Lie

The inventory-to-sales ratio dropped to 1.37 in August 2025. Down from 1.41 the prior year. Manufacturers are getting leaner. They're not stockpiling as much finished goods. This metric shows domestic production responding faster to demand shifts.

Shipments hit $607.7 billion per month in 2025. Flat year-over-year. The growth isn't in volume anymore. It's in value-add. Technical fabrics. Custom features. Fast turnarounds.

Job openings tell the future story. Manufacturing posted 409,000 open positions in August 2025. The ratio flipped to 1:1 unemployed worker per opening. Last year it was 0.92:1. Companies are hiring. The sector needs 3.8 million workers by 2033 to fill retirements and expansion.

Eighty percent of executives invest at least 20% of their budgets into production improvements. They're automating. Adding laser cutters. Installing real-time quality monitoring. The goal? Match overseas pricing with domestic speed.

Why BerunClothes Stands Out

Most factories tell you what they can't do. Berun starts each talk with what's possible.

Their Portland facility runs three production styles at once. Small-batch speed. Mid-volume efficiency. Large-scale consistency. You don't pick one and stick with it. Your order decides the approach.

The design process breaks industry norms. Upload your tech pack. Their team spots problems within six hours. Mesh panel creates chafing? They'll flag it. Compression won't work with your fabric weight? You'll know before sampling starts.

Sample rounds don't drain your budget here. Most makers charge $400-800 per prototype. Berun credits those fees back to your bulk order. Test four versions of your running short. Pay shipping. That's it.

Their fabric library goes beyond standard moisture-wicking polyester. Recycled ocean plastics. Bamboo-viscose blends. Compression knits that hold 15-20 mmHg pressure after 60 washes. Every material carries Oeko-Tex certification for dye safety.

Production speed sets them apart from US competitors. Payment clears. Your order enters production within 24 hours. Bulk runs finish in 2-4 days. Order size doesn't matter. Quality checks happen at three stages: cutting, assembly, and final inspection. They document seam strength tests. Color fade checks. Size accuracy tracking.

DHL and UPS air express handle shipping. Your custom running gear lands at Amazon FBA warehouses in 3-5 days. Total time from payment to your distribution center? Five to nine days. Argus Apparel quotes 21 days for similar orders. Indie Source needs 24 days minimum.

The 500-1,000 unit range fits emerging brands well. You're past the Kickstarter testing phase. Not ready for 5,000-piece overseas orders. Berun fills that gap with zero low-volume fees. Wholesale pricing holds steady at 500 units.

They produce over 100,000 pieces each month across 115 skilled workers. Small brands get the same care as volume accounts. Technical running tanks with anti-chafe flatlock seams? They'll prototype until the fit works right.

Conclusion

You can find the right custom running apparel manufacturer in USA without giving up quality, flexibility, or speed. The six manufacturers we've covered each bring different strengths. You might be launching a performance brand, outfitting a corporate running team, or creating limited race merchandise.

Made in USA production offers more than patriotic appeal. You get faster turnarounds. You get direct communication. Plus, you can verify quality control yourself. Brands serious about customer loyalty need that transparency.

Still comparing your options? Focus on three key factors: minimum order requirements that fit your current scale , production capabilities that match your technical specs, and a partner who wants to collaborate, not just manufacture.

Ready to move from research to production? Berun Clothes offers free sample evaluation and design consultation. No commitment required. Need 50 pieces or 5,000? Our team walks you through fabric selection, customization options, and realistic timelines. Request your custom quote today . See why emerging activewear brands choose agility over assembly-line work.