Finding the right manufacturer for quality running gear can make or break your athletic apparel brand. Most entrepreneurs waste months checking suppliers who can't deliver on moisture-wicking fabric, seamless construction, or real performance features.

The stakes are high. Choose the wrong partner, and you'll face quality complaints, missed deadlines, and damage to your reputation. This happens whether you're a startup founder looking for your first production partner, a retailer moving into technical activewear, or an established brand checking out alternatives.

This guide spotlights ten top manufacturers across global production hubs. You'll find China's integrated powerhouses and Europe's premium craftsmen. We've checked each one for their technical skills, quality standards, and proven track records.

You'll discover which factories excel at compression wear technology. You'll see who leads in sustainable production. More importantly, you'll learn how to match your specific needs with the right manufacturing partner. Think MOQ, lead times, and customization depth.

By the end, you'll have the clarity and confidence to make a decision. One that protects your brand and delights your customers.

1.Berunwear (China) - Innovator in Advanced Running Gear Technology

Berunwear stands out in China's competitive sportswear sector by focusing on high-tech, performance-oriented running apparel. Specializing in integrating cutting-edge fabrics with innovative design techniques, Berunwear is a go-to manufacturer for brands seeking to push the envelope in running gear.

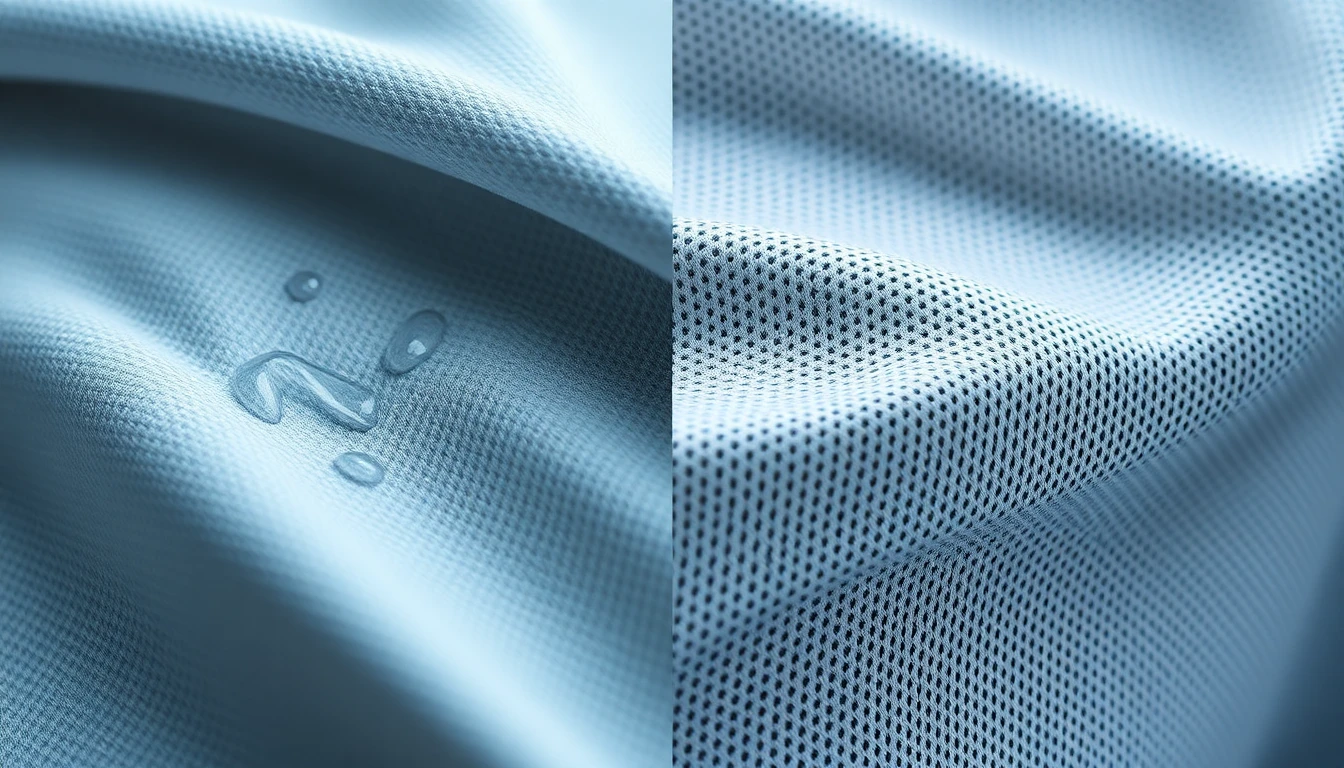

Technology and Fabric Specialization

Berunwear is renowned for its breathable, moisture-wicking fabrics, essential for long-distance runners and high-intensity athletes. Their research and development team has pioneered the use of smart textiles, incorporating temperature regulation and anti-odor properties into their running gear. Their fabrics feature advanced four-way stretch technology that ensures optimal movement during runs, whether on a track or a trail.

Compression wear and ergonomic design are at the heart of their production capabilities, designed to enhance performance and reduce fatigue. Berunwear’s products come with seamless construction, minimizing friction and maximizing comfort, even during intense workouts.

Sustainability and Customization

Berunwear is also committed to sustainable practices, with many of their materials sourced from recycled fibers. They work closely with clients to provide customization options, from design patterns to fabric blends. Their ability to deliver small batches with high customization levels makes them a great choice for growing athletic brands looking to maintain uniqueness while scaling production.

Berunwear also excels in offering quick turnaround times, making them an excellent partner for brands targeting rapidly changing markets. Their MOQ ranges from 500 to 1,000 units, making them a perfect choice for medium-sized brands and startups looking for a balance of quality and efficiency.

2. YONGFA (China) - Performance Running Apparel Specialist

YONGFA works in China's sportswear market. This market hit 492.6 billion CNY in 2023 . Growth continues strong.

Anta holds 16.2% market share. Nike leads with 25.2%. These giants grab the headlines.

YONGFA takes a different path. We focus only on technical running gear. No broad athletic categories.

Manufacturing Capabilities & Technical Focus

We focus on the performance segment. Moisture-wicking fabric and quick dry technology are standard here, not extras.

Our production lines use seamless construction techniques. These remove chafing points. Distance runners need this for long miles.

YONGFA's technical lineup includes four-way stretch fabric and compression wear technology . China's running community keeps growing. These features match what they want.

Breathable running shirts are a core product. They include ventilation panels and antimicrobial running clothes treatments.

Our lightweight athletic apparel uses fabrics matched to different climates. Humid southern provinces get one type. Dry northern regions get another.

Market Position & Distribution Strength

China's retail works digital-first. This helps YONGFA.

Online channels handle 38% of Asia-Pacific running gear distribution . Tmall and JD.com drive most discovery and sales.

The outdoor apparel segment on these platforms grew 26% year-on-year in H1 2025 . It reached USD 2.52 billion . This growth lifts makers like us.

Our ergonomic design running wear and reflective running gear cover performance and safety. Urban runners train in mornings or evenings along city routes. They need both.

3. VN Sportswear (Vietnam) - European-Standard Technical Apparel

Vietnam's technical sportswear factories grew to meet Europe's rising compliance needs. VN Sportswear operates at this sweet spot. EVFTA and CPTPP trade agreements enforce strict labor rights, environmental standards, and anti-corruption rules. EU buyers treat these as must-haves.

Certifications That European Brands Trust

The factory floor carries serious credentials. ISO 9001 , WRAP , SA8000 , and GOTS certifications aren't just for show. They're baseline requirements for Western contracts. Fabrics arrive with OEKO-TEX® chemical safety approval. Recycled content gets GRS verification. Products meet ASTM and EN standards before shipping.

This compliance depth supports brands selling to European retail chains. Those chains audit every part of the supply chain. VN Sportswear's records pass the test.

Technical Fabric Mastery for Performance Wear

Polyester-spandex blends dominate the production lines. These moisture-wicking fabrics are built for endurance sports. Four-way stretch fabric contains 15–25% elastane. This creates leggings and sports bras that move with athletes, not against them.

Seamless construction tech removes chafing points. Flatlock stitching reinforces stress zones—waistbands, underarms, crotch areas. It keeps skin contact smooth. Antimicrobial treatments and UPF sun protection come standard, not as extras.

Reflective details appear on sleeves, hems, and logos. European urban runners train before dawn or after dusk. Visibility means safety on shared roads and bike paths.

4. Sri Lanka Performance Apparel Hub (MAS-Type Factories) - Premium Innovation Leader

MAS Holdings and similar Sri Lankan factories go beyond basic manufacturing. They build technical running gear for brands that need precision.

The island shipped USD 4.535 billion in apparel exports in 2023 . Textiles and garments made up 41.82% of total exports . This wasn't about churning out volume. Sri Lankan factories built their space in sustainable, high-tech, premium markets .

Innovation-First Production Model

These factories dropped mass production years ago. They switched to high-quality, focused categories —underwear and performance sportswear .

Moisture-wicking fabric gets developed in-house. Seamless construction for compression wear technology happens the same way. Engineers combine four-way stretch fabric with antimicrobial running clothes treatments. Quick dry technology and breathable running shirts aren't extras. They're standard.

Digital product development technology keeps things moving fast. Custom ergonomic design running wear goes from idea to sample quickly. Athletic brands need this speed for seasonal launches.

Reflective running gear and lightweight athletic apparel lines meet EU compliance standards by design. Factories design for Western safety and environmental rules from the start.

Jan–April 2025 exports reached USD 1,497.91 million —up 11.59% year-on-year. Quality drove this growth, not quantity.

5. Turkey Tech-Run - Fast-Lead EU Market Specialist

Turkey's textile sector built its reputation on volume. Fast fashion. Cotton basics. Large orders shipped west. That foundation still exists. But something shifted.

Tech-Run represents the new wave. These factories stopped chasing volume. They started solving technical problems. European running brands need moisture-wicking fabric , seamless construction , and compression wear technology . They don't want the Asia shipping timeline. Tech-Run delivers.

Geographic Advantage That Matters

Istanbul to Frankfurt: two-hour flight . Fabric development to retail shelf: 4–6 weeks versus 12–16 from Asia. European brands test breathable running shirts or seasonal reflective running gear collections. Speed matters for trend-responsive markets. Turkey delivers it.

The country ranked 29th in the 2025 EU Innovation Index . Not elite, but climbing. Direct government R&D support sits at 145.2% of the EU average . High-tech imports reach 104% of EU benchmarks —the highest-ranked indicator in the country.

Real Technical Capacity, Real Gaps

Production floors handle four-way stretch fabric . They process antimicrobial running clothes treatments. Quick dry technology runs here too. Ergonomic design running wear with flatlock seaming ships to mid-tier European athletic labels.

Lightweight athletic apparel for trail and road running gets made here. Technical skills exist.

But venture capital sits at 1.3% of the EU average . ICT specialists rank lowest among neighboring countries. Innovation happens. But it's uneven. Some factories operate like European technical partners. Others still think fabric weight beats wicking speed.

Sales from new innovations hit 98.9% of the EU average in 2025—up 19.5 percentage points since 2018. Progress shows in output, not promises.

Turkey works best for European brands needing fast lead times . Medium-run production fits here. Factories understand EN standards without explanation. It's not cheaper than Asia. It's faster. And closer.

6. Portugal Performance Knit Factories - Premium European Craftsmanship

Portugal's knitted fabric industry hit €555.1 million in 2025. 167 enterprises built this revenue base. These aren't volume churners. They're precision makers.

Revenue grew at 5.2% CAGR from 2020 to 2025. Business count fell -2.3% CAGR in the same period. Fewer factories. More revenue. This pattern shows a shift toward quality.

Vertical Integration Powers Speed

Polopiqué in Santo Tirso runs the full chain. Spinning. Knitting. Finishing. Garment assembly. One partner takes moisture-wicking fabric from development to final seamless construction .

They call it "Texagility" —speed with flexibility. Breathable running shirts go from concept to sample in weeks, not months. Four-way stretch fabric gets tested on-site. Quick dry technology tweaks happen between floors.

Trial runs start at 100–300 units per style . Lead times hit ~8 weeks . European brands can test lightweight athletic apparel collections. No need for Asia's 12–16 week wait.

GRS , OCS , GOTS , and ISO 14001 certifications come standard. Programs like Valérius 360 and Fiber Loop help brands meet sustainability goals.

Finishing Depth Sets Portugal Apart

The textile finishing sector hit €1.8 billion in 2025. 817 companies operate here. Portugal ranks #6 in Europe by revenue and employees in this segment.

This finishing strength enables antimicrobial running clothes treatments. Reflective running gear details. Ergonomic design running wear with bonded seams and 3D shaping. Compression wear technology needs exact fabric handling. Portugal's finishers provide it.

Productivity reached €21,252 per worker in 2022, up from €20,115 in 2021. Workers know technical specs matter more than output speed.

7. Taiwan Functional Fabric + Garment Makers - Fabric Innovation Pioneer

Taiwan controls over 70% of the global functional fabric market . That's not a typo. Seven out of ten performance fabrics worldwide trace their technology back to this island.

Nike , Adidas , and Lululemon source more than 70% of their performance fabrics here. FIFA World Cup jerseys. Olympic team apparel. They all start in Taiwanese labs and factories.

In 2024, Taiwan exported USD 6.74 billion in textiles and apparel—up 1.5% year-on-year . Growth came from technical depth, not volume.

The Innovation Engine Behind the Fabrics

TITAS 2025 brought 388 exhibitors and 904 booths . About 70 international brands showed up. This wasn't a trade show. It was a fabric innovation showcase.

Taiwan's Ministry of Economic Affairs displayed 42 textile innovations . They worked with six research institutes : ITRI , TTRI , TTF , FTR , PIDC , and PITRI . These labs don't just test fabrics. They create moisture-wicking fabric , quick dry technology , and antimicrobial running clothes treatments. Brands get these innovations before they even ask.

RECODE 2050 featured 19 manufacturers and 6 designer brands . They presented 48 looks . The focus? Bio-based materials , circular production , and functional design . All meeting 2050 net-zero targets .

Vertical Integration That Delivers Speed

Li Peng Enterprise (Libolon) runs Asia's leading polymer-to-fabric vertical integration . They control the entire chain. Raw material synthesis to finished breathable running shirts . Eco-friendly , high-performance textiles ship faster. Fewer handoffs mean better speed.

New Wide Enterprise leads specialized circular knitting for performance sportswear. Four-way stretch fabric and seamless construction happen on precision machines. Most factories can't access these machines.

Singtex Industrial invented S.Café® coffee yarn . Recycled coffee grounds become lightweight athletic apparel . Their STORMFLEECE™ replaces traditional two-layer softshells. You get a single-layer woven-fleece hybrid instead. It cuts material waste. It reduces microfiber shedding. It improves wind resistance and durability.

Sabrina Fashion Industrial builds Olympic sportswear using these advanced fabrics. Compression wear technology , ergonomic design running wear , and reflective running gear details all meet elite athlete standards.

Technical Fabric Capabilities

Taiwanese factories create moisture management systems . They engineer thermal regulation —both heat retention and cooling. Wind and rain resistance comes through single-layer softshell solutions. Abrasion resistance for trail runners. Lightweight high-strength fabrics for competitive athletes.

For Paris 2024 Olympics , Taiwan supplied moisture-wicking , recycled fabrics for athlete apparel. These weren't standard polyester blends. They were ocean-recycled fibers and bio-based fabrics . Strict sustainability and performance benchmarks? They met them all.

New uses extend into medical , industrial , and adaptive-wear technical textiles. These need performance plus traceability . Taiwan's integrated supply chains deliver both.

Taiwan doesn't just make running gear fabrics. It invents them first.

8. Thailand Running & Triwear Factories - Sublimation Graphics Specialist

Sublimation printing turns polyester into a canvas. Thailand's factories mastered this process. Costs stay reasonable. Quality stays strict.

DRH Sports pushes 180,000 pieces through their production lines each month. Their sublimation tech bonds bright graphics into moisture-wicking fabric . The prints don't fade. They don't crack. They survive wash cycles that kill cheaper options.

Samples arrive in 48 hours . MOQ sits at 50 pieces . Small enough for triathlon clubs testing custom compression wear or running teams needing reflective gear with club logos.

CS Sport Thailand makes 240,000–300,000 pieces per year. That's 20,000–25,000 per month. Their MOQ drops to 20 pieces . Startup brands can build their first breathable running shirts collection here. No warehouse needed.

T-shirt Bangkok runs 40+ digital print methods . Water-based inks. Foil applications. Glow-in-the-dark details for night runners. Custom Pantone-matched dyeing hits exact brand colors for lightweight athletic apparel . Garment washes—stone, enzyme—add texture to quick dry fabrics.

Their MOQs split by method: 50 units for sublimation . 100 for screen printing . 300 for cut-and-sew custom patterns.

VT Garment handles bigger jobs. Sportswear MOQ: 1,000 units per style/color . Outerwear: 500 units . Sustainable collections drop to 300 units . Capacity reaches 136,000–182,000 pieces each month across five sites. Total output per year exceeds 1.2 million units .

Lead times run 45–60 days standard. Expedited production cuts this to 30 days . Their 1,200–3,000 workers run laser cutting, ultrasonic sealing, embossing, and embroidery lines. Seamless construction and ergonomic running wear get built with this tech depth.

Nan Yang Textile Group supplies the fabrics. No MOQ on fabric orders . Knitted products ship 3,000 tons each month. Printing capacity hits 1 million yards per month—reactive, discharge, pigment methods. Output per year reaches 31 million pieces .

Technical Standards That Matter

Sublimation needs 100% polyester or polyester-blend four-way stretch fabric . Temperature control stays tight: 380–420°F . Ink transfers from paper under heat. Graphics bond at molecular level. Then garments get sewn.

This process works well for antimicrobial running clothes treatments. The fabric chemistry accepts both coatings and bright prints. No interference.

The dye-sublimated apparel market will hit USD 8.1 billion by 2027 . Growth rate: 12.9% CAGR . Thailand's clothing defect rates stay below 2% . China's range: 5–15% . Quality control makes the difference.

Formative Sports uses this for triathlon wear. Sublimated tracksuits. Shorts. T-shirts. Skirts. All built for athletes who need graphics that survive chlorine, sweat, and sun.

Production scales from 200-unit small batches in Chiang Mai shops to 500,000+ units per month at bigger sites. Flexibility fits any brand size.

Thailand's sublimation factories do more than print graphics. They build them into performance fabrics that last.

9. Bangladesh Upgraded Sportswear OEM - Cost-Effective Volume Production

Bangladesh's garment sector shipped USD 39.35 billion in apparel exports during FY 2024–25. That's +8.84% growth. The US alone took USD 3.53 billion in just five months (January–May 2025)—a +21.6% jump.

This wasn't boutique production. This was volume at scale. 4+ million workers power these factories. Most are women. They run lines that turn bulk orders into finished goods. Speed? Faster than competitors can even sample.

The Cost Advantage That Moves Orders

Labor costs run lower than Vietnam, India, or China. This gap matters on 50,000-unit orders of moisture-wicking running shirts or compression leggings. Every dollar saved per piece adds up.

Q1 2025 proved it. Bangladesh's apparel exports to the US hit USD 2.22 billion . Up +26.64% in value and +25.24% in volume . Vietnam grew +13.96% in value during the same period. India managed +24.04% . China moved just +4.18% .

Bangladesh didn't just grow. It beat the field.

Mega Factories Built for Bulk

The factory setup runs on scale. Big facilities run the show. These aren't small shops. They're certified , ISO-audited operations with solid infrastructure and growing automation .

CAD/CAM systems , automated cutting , and ERP software keep production moving. A 100,000-piece order of breathable running shirts or quick-dry shorts flows through these lines. No hiccups.

Turnaround stays fast. Pricing beats most options. Brands need lightweight athletic wear or ergonomic running gear in serious volume? Bangladesh delivers.

The Technical Fabric Reality

Here's the catch. Bangladesh imports most high-performance synthetics . Think MMF blends , elastane , antimicrobial treatments , four-way stretch , seamless construction materials. The country doesn't make them yet.

This raises material costs . Lead times stretch compared to China or Vietnam's built-in fabric networks.

But the conversion cost edge still holds. Factories using imported tech fabrics still beat competitors on total landed cost for big runs. Labor efficiency makes up for fabric import costs.

The sector's moving into technical textiles . Money flows into sportswear , activewear , performance clothing , even smart clothing . Digital design tools and eco-friendly fabrics show the upgrade path.

Bangladesh works best for brands needing volume production at low cost in upgraded sportswear . Not cutting-edge fabric tech. But reliable, scalable, affordable bulk orders that hit international quality standards .

Reflective running gear or compression tights at mid-market prices? These factories solve it: quality × volume ÷ cost .

10. Berunclothes (China) - Speed and Precision for Activewear

Another leading manufacturer from China, Berunclothes specializes in high-performance activewear, particularly for runners. Their reputation has grown by delivering top-tier, lightweight running gear that combines function with cutting-edge design.

Focus on Lightweight, High-Durability Fabrics

Berunclothes’ expertise lies in creating lightweight, breathable fabrics that retain durability under extreme conditions. Their proprietary materials are engineered for moisture control and quick-drying performance, ideal for both short sprints and long-distance runs. Their running apparel is built to withstand frequent washes and extensive wear, maintaining color, shape, and texture even after many uses.

Customization and Competitive Lead Times

Berunclothes also offers impressive customization options for brands, from personalized designs to tailor-made fits for specific athletic needs. They are known for working closely with clients, ensuring that every product not only meets technical specifications but also aligns with brand aesthetics.

They provide rapid prototyping and fast lead times, often delivering products within 30 to 45 days, a critical factor for brands with tight deadlines. Their production capacity is adaptable to a variety of order sizes, making them a flexible partner for companies in different stages of growth.

How to Choose the Right Running Gear Manufacturer for Your Brand

Your manufacturer choice shapes everything. Product quality. Launch speed. Brand reputation. Cost structure. Pick the wrong partner and you lose months to delays, customer complaints, and wasted capital.

The running gear market grows fast. USD 90.44 billion in 2025 . Projected USD 131.89 billion by 2030 . That's 7.84% CAGR . Demand is there. So is competition. Your manufacturer decides which side you land on.

Start With Non-Negotiable Quality Standards

ISO 9001 isn't optional. It's baseline. This certification proves they have documented processes and consistent production. No ISO 9001? Walk away.

Ask for their defect rate . Premium performance lines should stay below 1–2% . Anything above 3–4% signals risk. Request data by style and season. Compare their numbers against brands at your price point.

Check their three-stage quality system :

- Raw material inspection after fabrics arrive

- In-line checks during production runs

- Final product validation before shipping

All three need documented SOPs. No documentation? No deal.

Some factories use AI-powered visual inspection now. This catches seam problems, logo misalignment, and color issues that human eyes miss. It's not required. But it separates serious operations from basic ones.

Verify Running-Specific Technical Skills

Generic activewear experience doesn't work for running gear. The construction needs differ.

Confirm they've built split shorts , 2-in-1 shorts , race singlets , half-tights , and wind-resistant jackets . Request 3–5 style samples from running clients. Check these details:

Flatlock seams that prevent chafing on long runs

Bonded seams or laser cutting for lightweight premium lines

Mesh ventilation panels placed where runners sweat most

Reflective prints that meet night-visibility standards

Examine stitch density. Running gear needs 8–12 stitches per inch on stretch seams. Test stretch recovery. Pull the waistband. Check the knees. Quality fabrics bounce back after 20–30 wash cycles . Cheap ones bag out.

Test Their Fabric Sourcing and Performance Knowledge

Ask about moisture-wicking fabric specs. Request lab test results —AATCC standards for wicking rate and dry time. Don't accept vague claims.

running apparel uses specific weights: - 120–160 g/m² polyester blends for singlets and tees - 15–25% elastane in tights and shorts for compression and stretch retention

Demand test reports on:

- Colorfastness to washing and sweat

- Pilling resistance for shorts that survive thousands of strides

- Abrasion resistance for tights rubbing against skin

Building a sustainable line? Verify their recycled polyester or organic cotton sources. Greenwashing happens. Real suppliers show certifications and traceability.

Check Innovation Speed and R&D Depth

The running market moves fast. Seasonal launches happen. Trends shift. You need a manufacturer with rapid prototyping .

Target: 2–3 weeks per iteration for new running styles. Factories using 3D design tools and fit simulation software hit this timeline. Those still working with hand sketches and postal samples don't.

Check for in-house R&D . Do they develop new smart textiles ? Temperature-regulating fabrics ? Integrated sensor housings for wearable tech? These skills matter if you're innovating beyond basic running tees.

Match MOQs and Capacity to Your Growth Stage

Startups die from too much inventory. Established brands stall from production limits. Get this match right.

Ask their minimum order quantities per color and size . Startup-friendly factories offer 100–300 units per style . Volume producers demand 1,000+ units . Know which you need before you negotiate.

Verify their monthly capacity for your core products. Planning to scale tees and shorts? Confirm they can handle 10,000+ pieces per month without quality drops.

Break down their lead times :

- Fabric sourcing: 15–30 days is standard

- Sample development: 10–15 days

- Bulk production: 30–45 days

- Shipping: varies by destination

Total timeline from order to delivery should stay under 90 days . Longer windows kill momentum.

Your manufacturer isn't just a vendor. They're your production partner. Choose one that grows with you.

Conclusion

Finding who manufactures high-quality running gear goes beyond sourcing products. You need partners who understand what modern athletes require. YONGFA offers complete performance solutions. Portugal brings premium craftsmanship. Each manufacturer here has unique strengths. Some excel at moisture wicking fabric innovation. Others focus on sustainable production or fast European turnaround times.

Your next step depends on what you need. B2B buyers? Contact 2-3 manufacturers that match your MOQ requirements and quality standards. Brand founders? Start with small-batch specialists in Portugal or the USA. Retailers? Check out the fabric technology capabilities of Taiwan or Sri Lanka-based factories. Critical factors matter here: certifications (OEKO-TEX, ISO), antimicrobial running clothes technology, and sustainable practices. These details separate exceptional partners from adequate ones.